Business Editors/Health/Medical Writers

FORT LAUDERDALE, Fla.--(BUSINESS WIRE)--July 30, 2003

Andrx Corporation (Nasdaq:ADRX) ("Andrx" or the "Company") today announced its financial results for the three and six months ended June 30, 2003, summarized as follows (in thousands, except per share amounts):

The 2003 second quarter income before income taxes of $23.6 million includes, among other things, a charge of $8.2 million related primarily to the writedown of certain assets at the Company's Massachusetts aerosol manufacturing facility that the Company previously announced it was seeking to possibly divest, and a $7.5 million charge relating to various previously disclosed legal claims and obligations.

The 2002 second quarter loss before income taxes of $60.2 million includes, among other things, a litigation settlements charge of $60 million related to the Company's Cardizem(R) CD antitrust litigation.

Andrx's Chief Executive Officer, Richard J. Lane, said: "In our generic business, our over-the-counter version of Claritin(R) D-24 and Taztia XT(TM), our bioequivalent version of Tiazac(R), were successfully launched this quarter. These launches combined with our licensing revenues from KUDCo on its sales of its generic Prilosec(R), contributed significantly to our top and bottom lines. We are also continuing to work on our Wellbutrin SR(R) and Zyban(R) products, and remain confident that we will be able to commercialize the value of our ANDAs and make generic versions of these significant products available to consumers. We also made considerable headway in improving our operations, particularly in manufacturing. This quarter's results also reflect the continued strength of our distribution operation which generated an all time high in net revenues."

Mr. Lane continued, "In our branded operations, we recently added a new leader for our commercial efforts, and launched the $AVE(SM) program, which provides Altocor(TM), our cholesterol-lowering medication, to consumers for a fixed monthly payment, without regard to age or income. Altocor was also added to Medi-Cal, California's state Medicaid drug list. We also filed a Marketing Authorization Application in the European Union for Fortamet(TM) (metformin XT) and had our valproate NDA product accepted for filing by FDA," concluded Mr. Lane.

In the second quarter of 2003, distributed products generated an all time high in net revenues of $161.5 million with gross profit of $29.0 million or gross margin of 17.9%. These results include the Company's participation in the distribution of a high sales volume, low gross margin cross-licensed version of Ciprofloxacin.

For the 2003 second quarter, revenues of Andrx's bioequivalent products increased by 36.9% to $66.2 million, compared to $48.3 million for the 2002 second quarter. Taztia XT, Andrx's bioequivalent version of Tiazac, was launched in April 2003 and generated net revenues of $14.3 million. Andrx's bioequivalent over-the-counter version of Claritin D-24 ("OTC D-24")was launched by Perrigo in June 2003 and provided Andrx with net revenues of $4.0 million. Both of these launches included initial stocking. Gross margin for bioequivalent products was 57.9% in the 2003 second quarter, as compared to 56.0% for the 2002 second quarter. The 2003 second quarter bioequivalent products gross profit includes charges of $1.1 million directly to cost of goods sold relating to Andrx's manufacturing facilities, including the Company's Weston, Florida manufacturing facility which is in the start-up phase, its Morrisville, North Carolina manufacturing facility, which the Company is planning to renovate, and under utilization and inefficiencies at the Company's Davie, Florida manufacturing facilities. Although not eliminated, under utilization and inefficiencies at the Company's Davie, Florida facilities improved significantly during the quarter.

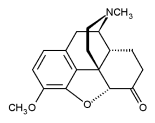

Revenues from Andrx's brand products in the 2003 second quarter increased to $10.5 million, from $7.4 million in the 2002 second quarter, primarily from net sales of Altocor of $6.9 million, partially offset by decreases in revenues from Andrx's brand cough and cold product lines, its Embrex(R) prenatal vitamin and its Anexsia(R) pain product line. Gross margin for the 2003 quarter was 84% compared to 51% for the 2002 quarter.

Licensing and royalties revenues for the 2003 second quarter of $33.1 million consisted almost entirely of estimated licensing revenues related to KUDCo's 2003 second quarter net profits, as defined, from KUDCo's sale of its generic version of Prilosec. On June 9, 2003, the licensing rate earned by Andrx from its agreement with KUDCo decreased from 15% to 9%.

Other revenues consist of $1.1 million associated with the Company's arrangement with Aventis relating to Andrx's Physicians' Online ("POL") web portal, as well as from contract manufacturing activities at Andrx's Massachusetts aerosol manufacturing facility. The 2003 second quarter cost of goods sold related to other revenues includes a charge of $8.2 million for the writedown of certain of the assets at the Company's Massachusetts aerosol facility, primarily related to inventories and property, plant and equipment. As previously disclosed, the Company is pursuing possible divestiture of both its POL physician Internet web portal and its Massachusetts aerosol manufacturing operations.

Selling, General and Administrative ("SG&A") Expenses

SG&A expenses of $58.2 million in the 2003 second quarter increased from $46.5 million from the 2002 second quarter, primarily as a result of an increase in brand sales force expenses. As of June 30, 2003, the Company had approximately 400 sales representatives, as compared to approximately 280 as of June 30, 2002. The increase in SG&A also includes the effect of the growth in total revenues and a change in product mix.

Research and Development ("R&D") Expenses

R&D expenses were $12.5 million in the 2003 second quarter, as compared to $11.4 million for the 2002 quarter. During the second quarter of 2003, Andrx submitted two ANDAs to the FDA and a Marketing Authorization Application in the European Union for Fortamet (metformin XT).

Litigation Settlements and Other Charges

Litigation settlements and other charges were $7.5 million for the 2003 second quarter, as compared to $60.0 million for the 2002 second quarter. The 2003 second quarter charge relates to various previously disclosed legal claims and obligations.

Balance Sheet and Cash Flows

As of June 30, 2003, the Company had approximately $158 million in cash, cash equivalents and investments available-for-sale, $297 million of working capital and $103 million available under the Company's $185 million secured credit facility, which had no borrowings outstanding. Cash flow from operations for the 2003 second quarter includes approximately $49 million in cash received from an income tax refund and $43 million received from KUDCo for licensing revenues earned by the Company from January through April 2003. For the three months ended June 30, 2003, the Company invested approximately $11 million in the purchase of property, plant and equipment and incurred approximately $7 million of depreciation and amortization expense.

Outlook

Growth in distribution revenues will continue to be primarily a function of the Company's participation in the distribution of new generic products launched by other generic manufacturers, offset by the net price declines typically associated with the distribution of existing generic products.

Growth in revenues of bioequivalent products is primarily generated from the launch of new products. Taztia XT, Andrx's bioequivalent version of Tiazac, was launched in April 2003 and is currently competing with one other generic product. Andrx's bioequivalent OTC D-24 was launched by Perrigo in June 2003, and is in its 180 day market exclusivity period. For the quarter ended June 30, 2003, revenues for Taztia XT were $14.3 million for a three-month period and revenues for OTC D-24 were $4.0 million for a one-month period. Final approval and Perrigo's launch of the Company's bioequivalent over-the-counter versions of Claritin-D(R)12 and Claritin Reditabs(R) are awaiting, among other things, the expiration of the exclusivity rights of other generic manufacturers in the third quarter of 2003. In the second half of 2003, the Company may also launch one or more oral contraceptive products. Andrx's bioequivalent version of Cardizem CD continues to generate significant net sales and gross profit for the Company. Additional competitors to generic versions of Cardizem CD and Tiazac may surface by mid 2004, which may significantly adversely affect net sales and gross profit of Andrx's bioequivalent versions of Cardizem CD or Tiazac and their significant contribution to Andrx's results of operations. Sales of Andrx's current bioequivalent products may also decrease as a result of other factors as well.

The Company is continuing to work on resolving the FDA and USP issues that affect its ANDAs for bioequivalent versions of Wellbutrin SR/Zyban. Though Andrx cannot at this time predict or advise whether or when such issues, and the related patent infringement litigation, will be satisfactorily resolved, and when these products will be introduced, the Company expects that it will be able to commercialize the value of its ANDAs and that generic versions of these significant products will become available to consumers. Such commercialization may be achieved through the Company's exclusivity rights with respect to such ANDAs.

Net sales of Altocor continued to grow to $6.9 million for the 2003 second quarter ($11.0 million for the first half of 2003). With, among other things, the $AVE program which Andrx rolled out in June, the Company now estimates that net sales of Altocor for 2003 could range from $30 million to $35 million. The Company continues to see Altocor as a significant opportunity and is exploring options for increasing the sales trend. In the second half of 2003, the Company is planning to consolidate its Mississippi brand sales administration office into its Weston, Florida offices, thereby incurring SG&A charges estimated at approximately $1.3 million.

Andrx expects to continue to generate significant licensing revenues from its agreement with KUDCo even though the licensing rate due to Andrx declined from 15% to 9% on June 9, 2003, in accordance with the terms of the related agreement. The Company believes that KUDCo licensing revenues will be significantly lower in the third quarter of 2003 as compared to the second quarter of 2003. The amount of licensing revenue derived by Andrx from KUDCo is dependent on a number of factors, including, among others, the applicable licensing rate, KUDCo's profits derived from its sale of its generic Prilosec, which are dependant on the number of units KUDCo produces and sells and its per unit selling price, the outcome of the various appeals involving generic Prilosec, and other factors outside of Andrx's control. The Andrx licensing rate on KUDCo's profits further reduces from 9% to 6.25% on the earlier of June 2004 or an appellate court decision, as provided in the agreement.

Andrx plans to begin the renovation of its manufacturing facility in Morrisville, North Carolina later in 2003 so that certain operations can commence at that facility in 2005. Andrx's Weston, Florida manufacturing facility is expected to become fully operational in 2004. The Company is also pursuing the divestiture of its Massachusetts aerosol manufacturing facilities and further renovations of, or ceasing certain manufacturing operations at, its Davie, Florida manufacturing facilities in order to continue to improve its manufacturing operations and increase its manufacturing efficiencies and capacities. Andrx is also continuing to improve its manufacturing and quality processes as well as the training and utilization of its personnel related thereto. Until all of these efforts come to fruition, Andrx will continue to incur charges directly to cost of goods sold related to its Weston, Florida and North Carolina facilities, under utilization and inefficiencies at its Davie, Florida facilities and excess capacities at its Massachusetts aerosol manufacturing facilities. The Company may also incur additional charges directly to cost of goods sold in the manufacture of its currently marketed products and product commercialization activities.

Andrx currently estimates that R&D expenses for 2003 will be approximately $55 million. R&D expenses will continue to be periodically evaluated throughout 2003 taking into consideration, among other things, the Company's level of profitability. During 2003, the Company expects to file at least 10 ANDAs, five of which have been submitted through June 30, 2003.

The Company's plan for the second half of the year includes continuing to pursue business development opportunities, primarily focused on leveraging Andrx's current brand sales force.

Andrx's operating results for the second half of 2003 will not include the initial stocking related to the launch of Taztia XT, and the higher licensing rate for KUDCo's sales of its generic Prilosec experienced in the second quarter of 2003. Major factors affecting the Company's operating results include KUDCo licensing revenues and net sales of its generic versions of Cardizem CD, and, to a lesser extent, Tiazac, OTC D-24, Dilacor XR(R) and Glucophage(R) and its brand Altocor product. Future operating results will also be affected by future product introductions, the value and timing of which are dependent on a number of factors including successful scale-up, final FDA marketing approval, satisfactory resolution of patent and antitrust litigation, manufacturing capabilities and capacities, competition and the other factors described in Andrx's SEC filings.

Webcast

Investors will have the opportunity to listen to management's discussion of this release in a conference call to be held on July 30, 2003 at 8:00 AM Eastern Time. This call is being webcast and can be accessed at Andrx's website http://www.andrx.com. The webcast will be available for replay.

About Andrx Corporation

Andrx Corporation develops and commercializes: bioequivalent versions of controlled-release brand name pharmaceuticals using its proprietary drug delivery technologies; bioequivalent versions of specialty, niche and immediate-release pharmaceutical products, including oral contraceptives; and brand name or proprietary controlled-release formulations of existing immediate-release or controlled-release drugs where it believes the application of Andrx's drug delivery technologies may improve the efficacy or other characteristics of those products. Andrx's distribution operations purchase primarily generic pharmaceuticals manufactured by third parties and sells them primarily to independent pharmacies, pharmacy chains which do not maintain their own central warehousing facilities, pharmacy buying groups and, to a lesser extent, physicians' offices.

Forward-looking statements (statements which are not historical facts) in this release are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements contained herein or which are otherwise made by or on behalf of the Company that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as "may," "will," "to," "plan," "expect," "believe," "anticipate," "intend," "could," "would," "estimate," or "continue" or the negative other variations thereof or comparable terminology are intended to identify forward-looking statements. Investors are cautioned that all forward-looking statements involve risk and uncertainties, including but not limited to, the Company's dependence on a relatively small number of products; licensing revenues; the timing and outcome of patent and antitrust litigation and future product launches; whether the Company will be awarded any marketing exclusivity period and, if so, the precise dates thereof; government regulation generally; competition; manufacturing capacities and output; the Company's ability to develop and successfully commercialize new products; the loss of revenues from existing products; development and marketing expenses that may not result in commercially successful products; Andrx's inability to obtain, or the high cost of obtaining, licenses for third party technologies; commercial obstacles to the successful introduction of brand products generally; exclusion of Andrx's brand products from formularies; the consolidation or loss of customers; Andrx's relationship to our suppliers; the success of Andrx's joint ventures; difficulties in integrating, and potentially significant charges associated with, acquisitions of technologies, products and businesses; the inability to obtain sufficient supplies from key suppliers; the impact of returns, allowances and chargebacks; product liability claims; rising costs and limited availability of product liability and other insurance; the loss of key personnel; failure to comply with environmental laws and the absence of certainty regarding the receipt of required regulatory approvals or the timing or terms of such approvals. Andrx Corporation is also subject to other risks detailed herein or detailed from time to time in its filings with the U.S. Securities and Exchange Commission, including, but not limited to, the Company's Annual Report on Form 10-K for the year ended December 31, 2002 and Form 10-Q for the quarter ended March 31, 2003.

This release and additional information about Andrx Corporation is also available on the Internet at: http://www.andrx.com.

COPYRIGHT 2003 Business Wire

COPYRIGHT 2003 Gale Group