FORT LAUDERDALE, Fla.--(BUSINESS WIRE)--April 27, 1999--

ANDRX CORPORATION (Nasdaq:ADRX) today announced its results for the three months ended March 31, 1999. For the 1999 first quarter, Andrx reported net income of $6,944,000 or $0.43 per diluted share as compared to a net loss of $960,000 or $0.06 per diluted share for the 1998 first quarter.

Total revenues increased by 53.7% to $77,924,000 for the 1999 first quarter as compared to $50,695,000 for the 1998 first quarter.

For the first quarter of 1999, sales from distributed products increased by 31.1% to $63,025,000 as compared to $48,080,000 for the 1998 first quarter.

Sales from manufactured products increased to $4,373,000 for the 1999 first quarter as compared to $2,615,000 for the 1998 first quarter.

In the 1999 first quarter, Andrx earned $10,000,000 in stipulation fees under its status quo stipulation and agreement with Hoechst Marion Roussel Inc. and Carderm Capital L.P.

Gross profits from sales of distributed products were $12,456,000 or a gross margin of 19.8% in the 1999 first quarter, as compared to $7,141,000 or a gross margin of 14.9% in the 1998 first quarter. This represents the 27th consecutive quarter (every quarter since inception) with an increase in gross profits from the distribution operation. The gross margin percentage in the 1999 first quarter was higher than historical trends and may not be indicative of the expected gross margin percentage in future periods.

Manufacturing costs, which consist of costs of manufactured products as well as idle facility costs, were $2,257,000 for the 1999 first quarter as compared to $998,000 for the 1998 first quarter.

Selling, general and administrative expenses were $8,808,000 or 11.3% of total revenues for the quarter ended March 31, 1999, as compared to $6,081,000 or 12.0% of total revenues for the quarter ended March 31, 1998. The increase in selling, general and administrative expenses was primarily due to an increase in the activities necessary to support the increase in sales from distributed and manufactured products.

Research and development expenses were $4,405,000 in the 1999 first quarter, as compared to $3,096,000 in the 1998 first quarter. The increase in research and development expenses of $1,309,000 or 42.3% reflects the progress and expansion of the Company's development activities for its bioequivalent (ANDA) and brand name (NDA) drug development programs.

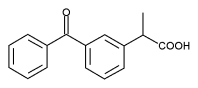

The Company's equity share of losses in ANCIRC Pharmaceuticals, its 50/50 joint venture with Watson Pharmaceuticals, Inc. (NYSE:WPI), decreased to $148,000 for the 1999 first quarter, as compared to $298,000 in the 1998 first quarter. This decrease was primarily attributed to the launch of ANCIRC's first product, a bioequivalent version of Trental(R) in September 1998. ANCIRC received approval of its second product, a bioequivalent version of Oruvail(R) on March 24, 1999, and commenced selling this product on April 19, 1999.

In the 1999 first quarter, the Company incurred $2,744,000 of software development and administrative costs as compared to $490,000 in the 1998 first quarter. The increase in software development and administrative costs primarily relates to progress in software applications and the establishment of the related administrative infrastructure by Cybear, Inc. (OTC Bulletin Board:CYBR), the Company's Internet based communications technology subsidiary.

In the 1999 first quarter, the Company and a former employee who claimed that he was entitled to receive a royalty equal to 1% of gross revenues from the Company's versions of Dilacor XR(R) and Cardizem(R) CD, agreed to settle their claims against each other with a payment from Andrx to such employee of $545,000.

In the 1999 first quarter, Andrx recognized a gain of $300,000 on the sale of Cybear, Inc. common stock to Cybear, Inc.'s Chairman pursuant to the previously announced subscription agreement.

In the 1999 first quarter, the Company provided $2,016,000 for federal income taxes or 22.5% of income before taxes. The Company was not required to provide for federal income taxes in the 1999 first quarter at the Federal statutory rate of 35.0% due to the utilization of net operating loss carryforwards.

The diluted weighted average shares of common stock outstanding were 16.2 million in the 1999 first quarter as compared to 14.9 million for the 1998 first quarter. The increase in such diluted weighted average shares of common stock outstanding in the 1999 quarter, as compared to the comparable 1998 quarter resulted primarily from the inclusion of stock equivalents in the profitable 1999 quarter.

"The obvious news is that we reported our most profitable quarter ever," commented Alan P. Cohen, co-chairman and chief executive officer of Andrx. "I am particularly pleased that this achievement was not brought about by sacrificing future growth. To the contrary, we set not only an earnings record, but an investment spending record. Investment spending creates exactly the conditions necessary to fuel our growth."

Forward-looking statements (statements which are not historical facts) in this release are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements contained in this report that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as "may," "will," "expect," "believe," "anticipate," "intend," "could," "would," "estimate," or "continue" or the negative other variations thereof or comparable terminology are intended to identify forward-looking statements. Investors are cautioned that all forward-looking statements involve risk and uncertainties, including those risks and uncertainties detailed in the Company's filings with the Securities and Exchange Commission.

Contact: Angelo C. Malahias, Vice President and Chief Financial Officer of Andrx Corporation, 4001 S.W. 47th Avenue, Fort Lauderdale, Florida 33314, 954-584-0300. This release and additional information about Andrx Corporation are also available on the Internet at: http://www.andrx.com.

Summary financial highlights are as follows: -0-

COPYRIGHT 1999 Business Wire

COPYRIGHT 2000 Gale Group