Business Editors/Health/Medical Writers

HAWTHORNE, N.Y.--(BUSINESS WIRE)--Feb. 20, 2003

Taro Pharmaceutical Industries Ltd.(NASDAQ:TARO):

2002 Highlights

Financial Highlights (,000)(1)

(1) Except per share data.

Taro Pharmaceutical Industries Ltd. (Nasdaq/NMS: TARO) today reported record fourth quarter and year-end results for 2002.

Fourth Quarter 2002 Results

The fourth quarter was Taro's 28th consecutive quarter of record sales and 18th consecutive quarter of record net income. Sales for the fourth quarter of 2002 increased 43% to $61,976,000, compared with sales of $43,459,000 for the fourth quarter of 2001.

Taro's gross profit in the fourth quarter of 2002 increased 38% to $38,541,000, or 62% of sales, from $27,905,000, or 64% of sales, in the fourth quarter of 2001. Selling, general and administrative expenses in the fourth quarter of 2002 were $15,022,000, or 24% of sales, compared with $10,898,000, or 25% of sales, in the fourth quarter of 2001.

Operating income before R&D expenses increased 38% to $23,519,000, or 38% of sales, compared with $17,007,000, or 39% of sales, in the fourth quarter of 2001. R&D expenses for the fourth quarter of 2002 were $7,993,000, compared with $5,811,000 in the fourth quarter of 2001, which was 13% of sales in both periods. Operating income for the quarter increased to $15,526,000 or 25% of sales compared with $11,196,000 or 26% of sales for the same period in 2001.

Net income for the fourth quarter of 2002 increased 32% to $12,925,000, or $0.44 per diluted share, compared with $9,826,000, or $0.34 per diluted share, for the fourth quarter of 2001.

"The results of the fourth quarter reflect excellent top line growth and profitability. The investment in promotion and advertising of proprietary products increased during the quarter and is expected to continue as Taro pursues its proprietary marketing initiatives in the United States and elsewhere," said Barrie Levitt, M.D., Chairman of the Company.

Full Year 2002 Results

Net sales for the year ended December 31, 2002 increased 42% to $211,581,000, compared with sales of $149,230,000 in 2001.

Gross profit in 2002 was $132,113,000, or 62% of sales, compared with $94,494,000, or 63% of sales, in 2001. Selling, general and administrative expenses for the year were $52,481,000, or 25% of sales, compared with $42,086,000, or 28% of sales, in 2001.

Operating income before R&D expenses in 2002 was $79,632,000, or 38% of sales, compared with $52,408,000, or 35% of sales, in 2001. R&D expenses were $26,373,000, or 12% of sales, compared with $19,633,000, or 13% of sales, in 2001. Operating income in 2002 was $53,259,000 or 25% of sales, compared with $32,775,000 or 22% of sales, in 2001.

Net income for 2002 increased 71% to $44,555,000, or $1.52 per diluted share, based on 29,408,194 weighted average shares outstanding, compared with net income of $25,994,000, or $0.99 per diluted share, based on 26,301,929 weighted average shares outstanding in 2001.

Strong Balance Sheet

At December 31, 2002, total assets were $378,708,000, compared with $307,762,000 at the end of 2001. Cash and cash equivalents were $130,717,000, compared with $150,732,000 at the end of 2001. Total liabilities were $108,412,000, compared with $88,622,000 at the end of 2001. Shareholders' equity was $269,137,000, compared with $218,364,000 at December 31, 2001.

U.S. Operations

For several years, the U.S. market has accounted for more than 85% of Taro's sales. In 2002, the Company organized its U.S. operations into three divisions: Taro Generics, TaroPharma and Taro Consumer Healthcare Products ("TCHP"), each focused on optimizing performance in a discrete sector of the market.

Taro Generics focuses primarily on the Company's core business of marketing generic products to the pharmaceutical trade. Through this division, Taro is expanding its commitment to the U.S. generic market. The Company expects this division to continue as the main driver for Taro's near-term growth.

TaroPharma was created in 2002 to initiate direct-to-physician marketing of the Company's proprietary prescription products. In establishing this division, Taro recruited a core team of professional medical representatives who have existing relationships with dermatologists and pediatricians. Initial product offerings for this division include Ovide(R), Topicort(R), Primsol(R) and A/T/S(R).

TCHP was established for direct-to-consumer marketing of proprietary over-the-counter products. The division has secured nationwide placement for Kerasal(R), a unique moisturizing exfoliant for use on dry, callused feet. TCHP is currently promoting Kerasal(R) directly to consumers. In 2003, TCHP plans to launch over-the-counter products based on Taro's NonSpil(TM) liquid drug delivery system. These spill-resistant formulations are expected to provide consumers with increased ease and accuracy of dosing. However, there can be no assurance of the timing or commercial success of these ventures.

Facilities Expansion

As sales continue to grow, Taro is increasing its manufacturing capacity to keep pace with demand for its products.

In May 2002, Taro acquired substantially all the assets of Thames Pharmacal, Inc., a pharmaceutical manufacturer with an FDA-approved plant located in Ronkonkoma, New York. The acquisition gave Taro its first U.S. manufacturing facility, providing additional capacity for production of topical and liquid products.

On February 18, 2003, Taro announced that it entered into an agreement to acquire a multi-purpose pharmaceutical plant located in Roscrea, County Tipperary, Ireland. Substantial grants from the Irish Development Agency have been approved by the Irish government to help offset the initial costs of staffing the operations. This 14-acre campus consists of 124,000 square feet of manufacturing, laboratory, office and warehouse space. The facility is licensed by the Irish Medicines Board to manufacture pharmaceutical products in Ireland for distribution in the European Union. Individual products to be manufactured by Taro at this new facility will require regulatory approval in each jurisdiction and there can be no assurance with respect to the granting or timing of such approvals.

In Israel, a new chemical facility is expected to begin production in the first half of 2003. Pharmaceutical plant expansion is also underway in Haifa and Toronto. Taro's current facilities expansion program should more than triple the Company's 2002 production capacity.

Approvals in 2002

In 2002, Taro received approvals for several Abbreviated New Drug Applications ("ANDAs") from the U.S. Food and Drug Administration ("FDA"). Approvals were granted for the topical corticosteroid Amcinonide Cream, bioequivalent to Fujisawa's Cyclocort(R) Cream, and the topical antifungals Ketoconazole Cream and Econazole Cream, bioequivalent to Janssen's Nizoral(R) Cream and Ortho's Spectazole(R) Cream, respectively. A tentative approval was granted for Loratadine Syrup, bioequivalent to Schering-Plough's Claritin(R) Syrup.

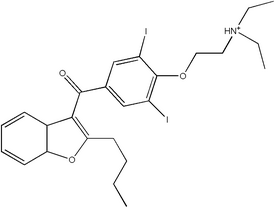

Supplemental ANDAs were approved for Amiodarone Tablets in 100 mg and 400 mg strengths. The 400 mg tablet is bioequivalent to Upsher-Smith's Pacerone(R) Tablets; Taro believes it is currently the only company with approval to market a 100 mg Amiodarone Tablet.

Proprietary Research

In December 2002, a New Drug Application ("NDA") was submitted to the FDA for a product incorporating Taro's NonSpil(TM) spill-resistant liquid drug delivery system. NonSpil(TM) pours like a liquid, but resists spilling. The Company holds several patents on NonSpil(TM) and additional patents are pending in the United States and elsewhere. The Company believes that the system's spill-resistant properties will permit increased ease and accuracy of dosing in children and the elderly.

In an early Phase II trial, T2000, the first of Taro's novel class of non-sedating barbiturates, showed effectiveness in reducing essential tremor, a common form of involuntary shaking. Published medical sources estimate that one-half to two percent of the adult population suffer from this disorder. An additional U.S. patent on T2000 has been filed for this indication.

As with any novel pharmaceutical product in development, there can be no assurance of final regulatory approval or successful commercialization.

U.S. FDA Filings

Currently, Taro has 24 filings at the FDA. These include the tentative ANDA approval for Loratidine Syrup, 20 additional ANDAs, 2 unique supplemental ANDAs, and the NonSpil(TM)-related NDA. The ANDAs address U.S. markets with annual sales in excess of $1 billion.

Conference Call

The Company will conduct a conference call to discuss fourth quarter and year end results on Thursday, February 20, 2003 at 11:00 a.m. Eastern Time (8:00 a.m. Pacific Time).

The call will be available live via the Internet by accessing www.taro.com. Online and telephone replays of the call will be available from approximately 1:00 p.m. on February 20th through February 28, 2003. The online replay can be accessed at www.taro.com. The telephone replay can be heard by dialing 1-800-428-6051 (domestic U.S.) or +973-709-2089 (international) and entering the passcode 286224 when prompted.

Taro is a multinational, science-based pharmaceutical company, dedicated to meeting the needs of its customers through the discovery, development, manufacturing and marketing of the highest quality healthcare products.

For further information on Taro Pharmaceutical Industries Ltd., please visit the Company's website at www.taro.com.

Certain statements in this release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements that are not describing historical facts, and comments concerning the Taro Generics, TaroPharma and TCHP divisions in the U.S., proprietary products, manufacturing operations in the U.S. and Ireland, expanded manufacturing operations in Israel, proprietary and generic research facilities and programs, increases in manufacturing capacity, proprietary products, and Taro's filings with the FDA. Although Taro Pharmaceutical Industries Ltd. believes the expectations reflected in such forward-looking statements to be based on reasonable assumptions, it can give no assurances that its expectations will be attained. Factors that could cause actual results to differ include general economic conditions, industry and market conditions, slower than anticipated penetration of new markets, changes in the Company's financial position, regulatory actions and legislative actions in the countries in which Taro operates or intends to market products, the viability of acquired facilities and difficulties in integrating them into the operations of Taro, marketplace and/or physician and patient acceptance of prescription or over-the-counter proprietary products developed or acquired by Taro, and other risks detailed from time to time in the Company's SEC reports, including its 2001 Annual Report on Form 20-F.

COPYRIGHT 2003 Business Wire

COPYRIGHT 2003 Gale Group