FORT LAUDERDALE, Fla.--(BUSINESS WIRE)--July 27, 1999--

ANDRX CORPORATION (Nasdaq:ADRX) today announced its results for the three and six month periods ended June 30, 1999. For the 1999 second quarter, Andrx reported net income of $48.9 million or $1.51 per diluted share as compared to a net loss of $1.7 million or $0.06 per diluted share for the 1998 second quarter. For the six months ended June 30, 1999, Andrx reported net income of $55.8 million or $1.73 per diluted share, as compared to a net loss of $2.7 million or $0.09 per diluted share for the six months ended June 30, 1998.

In June 1999, Cybear, Inc. (Nasdaq:CYBA), Andrx' 75% owned internet-based portal and provider of healthcare communications and applications subsidiary, completed a public offering of its common shares at $16.00 per share raising net proceeds of approximately $50.8 million. Exclusive of the net losses of Cybear, Inc., Andrx reported net income of $50.8 million or $1.57 per diluted share for the 1999 second quarter, as compared to a net loss of $1.0 million or $0.03 per diluted share for the 1998 second quarter. For the six months ended June 30, 1999, exclusive of Cybear's net losses, Andrx reported net income of $59.5 million or $1.85 per diluted share, as compared to a net loss of $1.4 million or $0.05 per diluted share for the six months ended June 30, 1998.

The record results for the 1999 second quarter are primarily the result of the resolution of the Hoechst Marion Roussel Inc. and Carderm Capital L.P. ("HMRI") patent infringement claim involving Andrx' bioequivalent version of Cardizem(R) CD. During the 1999 second quarter, the Company received interim and final fees pursuant to a Stipulation and Agreement with HMRI, and on June 23, 1999, the Company launched its bioequivalent version of Cardizem(R) CD, Cartia XT(TM).

Total revenues increased by 194.1% to $164.6 million for the 1999 second quarter, as compared to $56.0 million for the 1998 second quarter.

For the second quarter of 1999, sales from distributed products increased by 25.1% to $66.1 million, as compared to $52.9 million for the 1998 second quarter.

Sales from manufactured products increased to $36.5 million for the 1999 second quarter, as compared to $2.7 million for the 1998 second quarter. Sales from manufactured products include the Company's bioequivalent version of Dilacor XR(R), Diltia XT(R) and, commencing June 23, 1999, the Company's bioequivalent version of Cardizem(R) CD, Cartia XT(TM).

In the 1999 second quarter, Andrx received $60.7 million in interim and final fees from HMRI pursuant to a Stipulation and Agreement related to the recently resolved patent infringement litigation.

The Company recorded $1.2 million of licensing and other revenues in the 1999 second quarter as compared to $426,000 in the 1998 second quarter. Such revenues were primarily generated from the Company's domestic and international licensing arrangements.

Gross profits from sales of distributed products were $12.5 million or a gross margin of 18.9% in the 1999 second quarter, as compared to $8.0 million or a gross margin of 15.1% in the 1998 second quarter. This represents the 28th consecutive quarter (every quarter since inception) with an increase in gross profits from the distribution operation.

Gross profits from sales of manufactured products were $30.5 million or a gross margin of 83.5% for the 1999 second quarter as compared to $1.4 million or a gross margin of 51.1% for the 1998 second quarter. Manufacturing costs for the 1998 second quarter include idle manufacturing facility costs.

Selling, general and administrative expenses were $16.1 million or 9.8% of total revenues for the quarter ended June 30, 1999, as compared to $6.4 million or 11.4% of total revenues for the quarter ended June 30, 1998. The increase in selling, general and administrative expenses was primarily due to an increase in the activities necessary to support the increase in sales from distributed and manufactured products and includes a royalty to the Company's Co-Chairman and Chief Scientific Officer related to Stipulation fees and sales of the Company's bioequivalent version of Cardizem(R) CD.

Research and development expenses were $7.2 million in the 1999 second quarter, as compared to $4.1 million in the 1998 second quarter. The increase in research and development expenses of $3.1 million or 76.0 % reflects the progress and expansion of the Company's development activities for its bioequivalent (ANDA) and brand name (NDA) drug development programs. The Company's NDA program currently has one product in Phase III clinical trials.

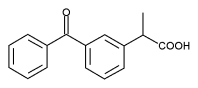

The Company's equity share of ANCIRC Pharmaceuticals, its 50/50 joint venture with Watson Pharmaceuticals, Inc. (NYSE:WPI), was $277,000 of income for the 1999 second quarter, as compared to $388,000 of loss in the 1998 second quarter. The current quarter's profitability was primarily attributed to the launch of ANCIRC products - a bioequivalent version of Trental(R) in September 1998, and a bioequivalent version of Oruvail(R) in April 1999.

In the 1999 second quarter, through its Cybear, Inc. subsidiary, the Company incurred $3.2 million of software development and administrative costs, as compared to $746,000 in the 1998 second quarter. The increase in software development and administrative costs primarily relates to progress in software applications and the establishment of the related administrative infrastructure by Cybear, Inc. During the 1999 second quarter, Cybear, Inc. launched its first product, SolutionsMD(SM).

In the 1999 second quarter, the Company provided $30.0 million for Federal and state income taxes or 38.0% of income before income taxes.

The diluted weighted average shares of common stock outstanding were 32.5 million in the 1999 second quarter as compared to 30.0 million for the 1998 second quarter. The increase in such diluted weighted average shares of common stock outstanding in the 1999 quarter, as compared to the comparable 1998 quarter resulted primarily from the inclusion of stock equivalents in the profitable 1999 quarter. All shares and related per share calculations for all prior periods have been restated for the Company's May 17, 1999 two-for-one stock split effected in the form of a 100% stock dividend.

"Our recently announced licensing agreement, raising over $50 million for Cybear - what we believe represents the future for healthcare - and, after six years of R&D and litigation, being able to commence selling our bioequivalent version of Cardizem(R) CD as successfully as we have -- obviously, it has been an incredible quarter," said Alan P. Cohen, Chief Executive Officer and Co-Chairman of Andrx.

Summary financial highlights are as follows: -0-

COPYRIGHT 1999 Business Wire

COPYRIGHT 2000 Gale Group