There currently is scant evidence that the withdrawal of the cox-2 inhibitor Vioxx and subsequent cox-2 controversy has pushed arthritis sufferers over-the-counter in search of safer medicines, but that doesn't mean the opportunity isn't there.

One consequence from all the attention paid to the safety of cox-2 inhibitors and non-steroidal anti-inflammatory drugs as a class of pain relievers may be to drive physicians back to a step-therapy approach to treating osteoarthritis--starting with an analgesic with a low-risk profile, such as acetaminophen, for instance.

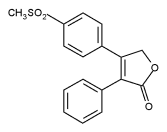

Indeed, even though such NSAIDs as ibuprofen and naproxen were associated with an increase in gastrointestinal complications, those remedies were an option at one time as a first line of treatment for arthritis pain. Cox-2 inhibitors were seen as an improvement on that regimen because drugs like Vioxx, Celebrex and Bextra do not carry the same concern over the stomach problem complications associated with the chronic use of NSAIDs.

"The typical patient with osteoarthritis makes that diagnosis before [he consults his family practitioner], commented Dr. Bill McCarberg, founder of Kaiser Permanente's chronic pain management program. "They'll have started glucosamine because they've read about it in Ladies Home Journal," he said. They will have tried Tylenol, Aleve or Advil and are looking to their doctors for a possibly more effective prescription remedy--prescription-strength Mobic, for example, or a cox-2 inhibitor.

Even so, doctors on the front line of osteoarthritis may revert to an NSAID-first approach toward pain management, possibly supplementing that regimen with a proton-pump inhibitor or H-2 blocker to take care of any gastrointestinal discomfort. And that places the first line of treatment for osteoarthritis squarely in OTC aisles.

Already, there has been evidence of an increase in the sale of internal analgesic tablets like Bayer's Aleve (naproxen) and McNeil's Tylenol (acetaminophen). For the 12 weeks ended Dec. 26, sales of Aleve grew 5.4 percent, reaching $37.1 million in food, drug and mass (minus Wal-Mart), while Tylenol Arthritis sales increased 19.8 percent to $14.2 million, according to Information Resources Inc.

And homeopathic supplier GelStat has stepped up its plans to launch GelStat Arthritis, which is expected to launch next month. "Clearly, with what's happening in the marketplace, there's increased demand for safe OTC solutions for people with arthritic pain. That has accelerated our efforts to get the product to market," commented Richard Ringold, GelStat vice president.

Another opportunity that exists along the front end of drug stores can be found in the dietary supplement aisle. The cox-2 controversy may breathe new life into sales of glucosamine and chondroitin products, which have been flagging, even in the wake of the Vioxx withdrawal, according to IRI data.

COPYRIGHT 2005 Reproduced with permission of the copyright holder. Further reproduction or distribution is prohibited without permission.

COPYRIGHT 2005 Gale Group