One company's earnings drag can be another company's boost, and that seems to be the case behind Novartis' acquisition of the Bristol-Myers Squibb over-the-counter portfolio.

The jewel in the crown is certainly Excedrin. And although sales of the venerable analgesic brand dropped 5.3 percent in the drug channel for the 52 weeks ended July 10, according to Information Resources Inc., the brand best known as the "headache medicine" certainly has a strong resonance among consumers, with a 96 percent brand awareness and more than $58.1 million in sales.

When first placing the division on the sales block, Bristol-Myers chairman and chief executive officer Peter Dolan explained that the OTC division did not have an as attractive growth rate as some of the company's other non-pharma businesses. "Excedrin, which is the largest asset [of the group], ... has a lower margin than the rest of our businesses," he reported.

But just because Bristol-Myers considered its OTC division dispensable, the brands Bristol-Myers sold are by no means cast-offs. In addition to Excedrin, there is Comtrex, Bufferin and the 4-Way nasal decongestant, all of which are established brands in their respective categories.

And Bristol-Myers has continued to invest in developing the Excedrin brand, introducing a Sinus Headache line extension with phenylephrine as its decongestant earlier this year. The last time-Bristol-Myers introduced a new product narrowing the definition of a headache--Excedrin Tension Headache in 2003--the brand helped drive growth through the entire category.

And while the last big Excedrin product launch didn't quite meet the company's expectations, it did represent a bold move in what has become a staid category. Bristol-Myers introduced a melt-in-your-mouth analgesic with a catchy television ad campaign that focused on product convenience with the slogan 'No need for water!"

Novartis is no stranger to taking risks and driving innovation through retail. The OTC company was one of the first to use the strip technology--first introduced as Pfizer's Listerine PocketPaks--as a delivery device in two of its main-line cough-cold brands: TheraFlu and Triaminic.

Under Novarits stewardship, the newly acquired Bristol-Myers brands are expected to realize a resurgence. Indeed, Novartis will be interested in realizing a quick return on its $660 million investment--one that analysts say was neither overpriced nor undervalued.

Novartis is likely to increase its trade support in an effort to drive sales higher. According to published reports, Novartis upped its advertising support across its cough and cold SKUs TheraFlu and Triaminic and across its digestive brands Maalox, Benefiber and Gas-X in 2004 compared with 2003.

Bristol-Myers, in contrast, had lessened its consumer advertising support of its flagship Excedrin brand--not surprising, considering the brand probably had been tagged internally with a "for sale sign long before the January announcement. Bristol-Myer's $50-million-plus ad support behind Excedrin equaled less than one-quarter the ad spend for analgesic category leader Tylenol. McNeil-spent more than $200 million supporting Tylenol last year. Ad support for Excedrin also trailed behind every other significant analgesic brand, including individual spends on Advil, Bayer and Aleve.

Novartis also recently put together dedicated teams for some of its key retail accounts, including Wal-Mart, CVS and Walgreens. "The biggest, most successful companies are growing at a disproportionately rapid rate--at the expense of the rest of the retailing community, reported Jim Shad, chief customer officer at Novartis Consumer Health, in Novartis' annual report. "You've got to fish where the fish are and win with the winners," he stated. Accordingly, that may mean more activity with its new OTC brands in those key accounts.

"The acquisition of these brands, particularly Excedrin, will provide us with greater critical mass in the OTC market in the United States, as well as with key trade customers who also purchase our prescription medicines and other consumer health products, stated Paul Choffat, chief executive officer of Novartis Consumer.

Indeed, with the new brands, Novartis may be able to realize synergies of scale where BMS could not. Novartis already has a decent position in cough-cold, digestives and foot care, but now the company adds a significant amount of shelf space in analgesics to its mix. Accordingly, Novartis has picked up a considerable amount of retail shelf real estate in this acquisition--something that is likely to result in more prominent facings and more frequent in-store promotions at retail.

Novartis also is hoping its newly acquired leverage will assist the company in attracting prospective partners for switch, Choffat said.

There are plenty of other opportunities with switch going forward. Sanofi-Aventis, which does not have a consumer health care division, could lose patent exclusivity on its blockbuster Allegra as early as 2006, depending on how the patent trial breaks. Generic versions already have Food and Drug Administration approval. Like Claritin, Allegra was one of the non-sedating antihistamines that had been recommended for switch approval by a pair of FDA advisory committees in 2001.

Tap Pharmaceutical Products may be in a similar situation when the patent protecting its proton-pump inhibitor Prevacid expires in the next few years. Tap is a joint venture between Abbott Laboratories and Japan's Takeda Pharmaceuticals, and although Abbott has an established consumer products division in Ross Products, neither company has a broad OTC portfolio.

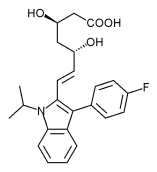

Novartis also has an internal opportunity should Bristol-Myers and Bayer successfully switch the statin Pravachol. While still considered a long shot, that switch could lay the groundwork for the Novartis switch application of its own statin, Lescol, when the timing is right--Lescol patents are not expected to expire before 2011.

COPYRIGHT 2005 Reproduced with permission of the copyright holder. Further reproduction or distribution is prohibited without permission.

COPYRIGHT 2005 Gale Group