Lipitor

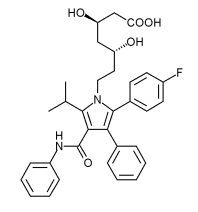

Atorvastatin (INN) (IPA: ) is a member of the drug class known as statins, used for lowering cholesterol and thereby preventing cardiovascular disease. Atorvastatin inhibits a rate-determining enzyme located in hepatic tissue used in cholesterol synthesis, which lowers the amount of cholesterol produced. This also has the effect of lowering the total amount of LDL cholesterol. more...

Unlike most statins, atorvastatin is a completely synthetic compound.

Atorvastatin is currently marketed by the pharmaceutical company Pfizer as Lipitor®. In some countries it may also be known as: Sortis®, Torvast®, Totalip®, or Xarator®. With 2004 sales of US$10.9 billion, it is the best selling drug in the world.

Clinical use

Indications

Atorvastatin is indicated as an adjunct to diet for the treatment of dyslipidaemia, specifically hypercholesterolaemia. It has also been used in the treatment of mixed hyperlipidaemia. (Rossi, 2006)

Available forms

Atorvastatin is marketed as atorvastatin calcium under the trade name Lipitor, in tablets (10, 20, 40 or 80 mg) for oral administration. Tablets are white, elliptical, and film coated.

Adverse effects

Common adverse drug reactions (ADRs) associated with atorvastatin therapy include: myalgia, mild transient gastrointestinal symptoms, elevated hepatic transaminase concentrations, headache, insomnia, and/or dizziness. (Rossi, 2006)

Myopathy and rhabdomyolysis are rare, but serious, dose-related ADRs associated with statin therapy. Risk is increased in patients with renal impairment, serious concurrent illness; and/or concomitant use of drugs which inhibit CYP3A4. (Rossi, 2006)

Mechanism of action

Atorvastatin is a competitive inhibitor of HMG-CoA reductase. This enzyme catalyzes the reduction of 3-hydroxy-3-methylglutaryl-coenzyme A to mevalonate, which is the rate limiting step in hepatic cholesterol synthesis.

Because cholesterol synthesis decreases, hepatic cells increase the number of LDL receptors on the surface of the cells, which increase the amount of LDL uptake by the hepatic cells, and decreases the amount of LDL in the blood.

Read more at Wikipedia.org