This may be dubbed the year of opportunity for OTC merchants in the drug channel. At least one new segment of the business has arisen in the past three months, potentially representing hand-over-fist incremental sales growth. And regardless of what finally happens with ephedra-based diet aids, drug stores still will have the opportunity to stem any major sales erosion in the category through pharmacist recommendations for OTC weight-loss alternatives.

And this doesn't even take into consideration a host of other category developments that will drive OTC growth beyond 2003.

New segment is nothing to sneeze about

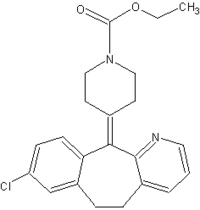

Few things will move the needle faster than a new OTC product for treating a chronic condition from which a high percentage of the population suffers. Enter the switch of loratadine this past December. The No. 1 KU in the non-sedating antihistamine segment of the sinus/allergy category already has raked in $23.2 million in drug stores for the 12 weeks ended Feb. 23, according to Information Resources Inc.

There are two significant observations to be made surrounding Schering-Plough's 10 mg Claritin sales results. First, because Schering-Plough switched all of its Claritin products Dec. 10, the numbers represent only 10 weeks of sales data. Second, the official kickoff of allergy season hasn't even happened yet. Sales only are going to get better.

Considering that Wyeth has been promoting its Alavert loratadine product since December, and Novartis last month introduced its Tavist ND loratadine version, you have a virtual cornucopia of branded manufacturers, each attempting to cement its brand .identity through consumer promotions. As far as the marketing push around these brands, they all have a long way to go to make up ground on Claritin, which benefits from several years of heavy DTC advertising. Expect this activity to heat up.

And then there is private label competition. Novartis has thrown its hat into the store brand ring for the first time-landing lucrative retail accounts with Walgreens, CVS, Rite Aid, Eckerd and Wal-Mart, among a slew of other prominent retailers-with private label loratadine products that started shipping as early as March. And long-standing store-brand suppliers Leiner Health and Perrigo will be entering the ring in June with their own offerings.

The consensus among these private label suppliers is that the overall sales volume for OTC loratadine should reach $500 million to $600 million in the segment's first full year of sales. And private label could claim 25 percent to as much 40 percent of that market, according to various estimates. That translates to anywhere from $125 million to $240 million in retail sales of private label loratadine.

A new way to kick an old habit

Newly available delivery forms, such as Glaxo-SmithKline's Commit smoking-cessation lozenge, which was launched in November, also can provide significant incremental sales opportunities. Available in two strengths, 2 mg and 4 mg-correlating to a smoker's level of nicotine addiction-the mint-flavored lozenge generated some $8.2 million in sales at the drug counter for the 12 weeks ended Feb. 23.

And the opportunity for growth in this recently spawned sub-category is tremendous. Glaxo is continuing to promote the new lozenge through in-store, point-of-purchase material and extensive radio campaigns. "Our intention is to use Commit to help grow the category," said Mark Lauff, director of customer development for smoking control at Glaxo, "and bring more users wanting to make a quit attempt through new product innovation."

Although no one at Glaxo would divulge future product development plans, a flavor extension down the line should be enough to spark another wave of interest in lozenge-based nicotine-replacement therapies. Indeed, when Glaxo extended its Nicorette gum products with mint, and later orange flavors in 2001, it generated renewed interest in the whole smoking-cessation category.

Leveraging pharmacists in weight-loss counseling

By mid-April, the Food and Drug Administration had still not decided whether it would ban ephedra from the market altogether or impose further restrictions on marketing and merchandising the herbal diet aid. Whatever the FDA decides, the precipitous drop in ephedra sales is creating a bit of a vacuum in the diet aid tablet category.

The mother of all ephedra products, Metabolife, which set the pace in the segment through the boom, is now facing a sales freefall. Sales for the brand, which had grown almost 127 percent in 2001, fell 25 percent in 2002. The momentum definitely has reversed itself. Many suppliers and retailers are pulling out of the business in response to a hike in product liability premiums, and consumers have been abandoning the category in droves since the ingredient was linked to the death of Baltimore Orioles pitcher Steve Bechler by the Broward County coroner's office in Florida.

And though many may not view these developments as positive, drug store retailers surely will want to recover some of the $125 million they made selling ephedra products last year. Consumers could find what they're looking for in such ingredients as green tea extract, 7-kito DHEA products and conjugated linoleic acid, suggested Jim LaValle, R.Ph., C.C.N., published author and chief clinical officer of Intramedicine. "Another agent that is somewhat similar to ephedra, but does not have the negative impact on blood pressure--citrus orantium, or orange peel extract," LaValle added.

Though dietary supplements can assist in weight loss, LaValle said the reality on weight loss is proper nutrition and increased activity. "In the end you always have to emphasize that," he said. And this is where the pharmacist can give drug stores a decided edge over other retail channels that also will be looking to replace lost ephedra sales--that is, as long as drug chains engage their pharmacists in patient counseling and load them up with the information that they will need to seize the existing opportunity to recommend alternative OTC weight loss products.

Other developments to watch

The FDA's recent announcement of its mandated good manufacturing practices for dietary supplement manufacturers should have a positive impact on the natural health business in the years to come, as the industry works to regain some credibility with consumers and the news media that helps shape consumer opinions. As it now stands, the new GMPs will be implemented next year if all goes as planned, and companies will have up to three years to comply, depending upon their size.

By 2005, most supplements will fall into compliance with the new regulations, robbing reporters of the ability to bandy about the pointed adjective "unregulated" in describing the industry. All dietary supplement manufacturers will be required to be on board wit the new GMPs by 2007.

Couple this with a few other developments, such as the Journal of the American Medical Association's recommendation that all Americans should take a multivitamin, and this could portend the beginning of a turnaround for natural health/nutrition. For the 12 weeks ended Feb. 23, multivitamin drug store sales grew 12.5 percent to $76.4 million. In herbal supplements--a segment that has been hammered over the past few years--certain other factors, such as the recent buzz around hormone-replacement therapy and the related health risks of heart attack, stroke and breast cancer, have renewed interest in black cohosh supplements. Sales for that ingredient were up 95.6 percent to $2.2 million in drug stores during the 12 weeks ended Feb. 23.

In addition, a growing number of health-centric baby boomers seem to be getting the message on heart-healthy ingredients like coQ 10 enzymes and fatty acids/fish oils. Sales for those products grew in high double digits, to ether ringing in more than 10 million during that 12week period.

All of these factors suggest a billion-dollar-plus category in which sales trends may once again shift positive.

If Procter & Gamble's Prilosec 1, the OTC version of the heartburn prescription remedy, Prilosec, successfully makes a switch later this year as anticipated, it certainly will provide a jolt to the digestives sector of the business. And this would be gravy for a mature OTC category that has performed relatively strongly in recent months. During the 12 weeks ended Feb. 23, IRI shows drug store sales in the category up 5.3 percent, reaching $167.4 million.

The company has had a pretty good track record as of late with new OTC products, as evidenced by the growth in ThermaCare heat wraps. P&G's insistence that ThermaCare be merchandised alongside internal analgesics--right under the noses of the majority of pain relief customers--has sparked renewed interest in wrap/patch therapy. Sales of heat/ice packs in drug stores rose 70.8 percent, reaching $21.1 million for the 12 weeks ended Feb. 23 and were up 76.6 percent to $78.3 million for the full 52 weeks ended Feb. 23. Almost half of those sales are made up of ThermaCare products. Drug stores sold $9.3 million worth of ThermaCare heat wraps for the 12week period ended Feb.23 after little more than a year on the market.

There is speculation that analgesics may receive a further bump in sales following the recent FDA approval of a lower-dose and less-drowsy Flexeril, Johnson & Johnson's prescription muscle relaxer, The new version ships this month. And there is J&J d reason to believe that ma y look to switch the lower-dose Flexeril to OTC status. The company tried to switch the original version in 1999, but had its application rejected by the FDA. Though J&J officials aren't tipping the company's hand, its decision to grant marketing control for the low-dose form to its McNeil Consumer division, according to published reports, certainly suggests that OTC is in the brand's future.

COPYRIGHT 2003 Reproduced with permission of the copyright holder. Further reproduction or distribution is prohibited without permission.

COPYRIGHT 2003 Gale Group