ROBINSON OWNSHP, Pa. -- Though not quite the merger agreement the company was in search of last year, Bayer brokered an agreement earlier this month under which all of its approved pharmaceuticals for the United States market will be marketed and distributed by Schering-Plough.

Bayer stands to save an estimated 75 percent in U.S. infrastructure costs--the company would not share an actual dollar figure--which includes the loss of 1,800 Bayer sales representatives who either will make the jump to Schering or be let go. Meanwhile, Schering-Plough picks up a much-needed boost to its product portfolio, a portfolio that now will include the antibiotic Cipro and the erectile dysfunction drug Levitra.

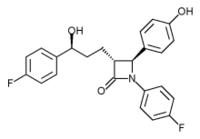

Perhaps the biggest advantage for Schering-Plough will be the influx of an experienced sales force to help drive the company s resurgence under the guidance of turnaround specialist Fred Hassan. The company's most promising drug remains Vytorin, a combination of Merck's Zocor and Schering-Plough's Zetia that Schering markets with Merck, which was approved in July.

Vytorin, which competes against the likes of statins Lipitor and Crestor, is expected to reach $3 billion in U.S. sales at its peak.

While this deal gives Schering-Plough a little more weight in the respiratory market, all of the sales of its newly licensed medicines combined do not add up to one blockbuster. The two drugs with perhaps household name status--Cipro and Levitra--are not exactly exemplary sales drivers. Cipro is quickly ceding sales to its generic competition--the antibiotic lost patent protection earlier this year--and sales of Levitra are split now among three companies. Originally, Bayer and GlaxoSmithKline partnered on the marketing of Levitra, which has gained 10 percent of the erectile dysfunction market since its launch last year. Now Schering-Plough and Bayer will make an undisclosed split (presumably favoring ScheringPlough) after GlaxoSmithKline receives their share of revenue.

Still, the deal allows Bayer to pour its savings from marketing those medicines into a new oncology department, and Schering-Plough now fields a more diverse portfolio.

"We see Bayer's selection of Schering-Plough as a U.S. primary care partner to be a validation of our evolving strength in this critical market," explained Fred Hassan, Schering-Plough chairman and chief executive officer, to a group of potential investors at the Bear Stearns health care conference earlier this month.

"Schering-Plough will purchase these products from Bayer at negotiated sales volume dependent rates, and ScheringPlough will also record U.S. end-market sales for these products, which were approximately [$400] million for the first half of 2004, said Arthur Higgins, chairman of the Bayer Healthcare Executive Committee, during a conference call on the day of the announcement.

"This strategic agreement represents a further step in our action agenda to build the new Schering-Plough," said Hassan. "The collaboration will enhance our primary care product line and complement our respiratory franchise."

Schering-Plough also will market the Bayer antibiotic Avelox, indicated for certain respiratory and skin infections, and the cardiovascular product Adalat.

All of the Bayer products now being sold by Schering-Plough will continue to be sold under the Bayer banner. Bayer will also continue to assume product liability for the medicines now licensed by Schering-Plough.

The agreement covers only those Bayer products already approved, not those in development, and potentially restricts ScheringPlough from marketing products in the United States that would compete with Bayer's quinolone antibiotic Avelox. That being the case, Schering-Plough expects it may need to sublicense rights to garenoxacin, currently being developed by Toyama Chemical.

COPYRIGHT 2004 Reproduced with permission of the copyright holder. Further reproduction or distribution is prohibited without permission.

COPYRIGHT 2004 Gale Group