SmithKline's Tagamet Ups Ante with Liquid, $29M Ads

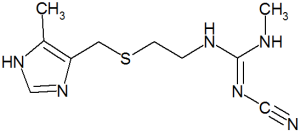

Looking to give its Tagamet antacid brand a much-needed boost, SmithKline Beecham will invest $29 million on a television ad campaign to kick off the introduction of Tagamet HB 200 Liquid, the first second-generation antacid, or H2 blocker, to become available in liquid form. It will launch in a 12-oz. bottle in Cool Mint flavor, per trade sources.

Tagamet has been one of the suffering brands in the intense inter-category war between immediate-action and preventative antacids, spurred by Rx-to-over-the-counter H2 blocker switches and, more recently, the rise of private label brands.

Pittsburgh-based SmithKline's effort is anchored by consumer research indicating that antacid form is one of the highest purchase priorities for consumers, with liquid fans currently forced to settle for immediate-relief products only. SmithKline is hoping that by being the first manufacturer to get an OTC liquid H2 blocker out, it can reverse the brand's erosion even while capturing a higher price on a per-dose basis.

While sales in the stomach remedies category have risen slightly this year, Tagamet sales have dropped by almost 17% as of April 25, putting it behind all the modestly performing liquid brands like Mylanta and Maalox, per scanner data from Information Resources Inc. At the same time, SmithKline has done an exceptional job with Tums, No. 2 in the category and up 15%, while J&J/Merck's category-leading Pepcid brand has eased off by 2%. In response to essentially flat sales of Pepcid over the past several years, J&J rolled out a chewable form last year, and a gelcap is expected to come next.

TV spots, likely playing up the soothing feeling of a liquid in contrast to a tablet and the medicine's ability to offer "long-lasting relief," break around Nov. 28, likely via Jordan McGrath, New York, the brand's lead agency. In sales materials, SmithKline claimed consumers reported that Tagamet Liquid provided relief lasting five times longer than Mylanta, and a soothing feeling at the onset of symptoms.

The heavy ad support will be buttressed by unusually generous consumer sampling inducements, as SmithKline looks to get the liquid into as many hands as possible by eliminating price as an obstacle. All initial shipments will have a $5 mail-in refund on the box, worth more than half the shelf price of the product. Rolling in a 12-oz. bottle containing about 18 doses, Tagamet Liquid will be line priced with the 30-count tablet at about $8.50. Full-and half-page national FSIs offering $2 off liquid and $1 off the tablets are scheduled for Nov. 14, Jan 2, April 2, June 25, Aug. 27 and Nov. 11. In addition, during the launch SmithKline will also offer $1 coupons in stores at national food and mass outlets, along with POP at food, drug and mass stores.

The Food and Drug Administration has not approved Tagamet Liquid for children under 12, and is requiring that the product carry a bold warning to emphasize that its safety for children has not been determined. If Tagmet Liquid later wins approval for children, it would more directly compete with traditional over-the-counter stomach liquids, such as Procter & Gamble's Pepto-Bismol and Mylanta, that can be used by children.

Putting the most into media for its premier brand, Tums, SmithKline committed only $20 million to Tagamet in 1998 and $10 million in the first six months of this year. By contrast, Tums received $39 million and $24 million in spending, respectively, according to Competitive Media Reporting.

COPYRIGHT 1999 BPI Communications, Inc.

COPYRIGHT 2000 Gale Group