BOCA RATON, Fla. -- In 2004, generic drugs made up 45.8 percent of total prescription drugs dispensed, with branded generics, a growing segment, comprising 10.6 percent and branded drugs capturing the remainder, according to newly released data from IMS Health.

At the Generic Pharmaceutical Association's annual meeting here last month, Alan Lotvin, Medco Health Solutions president of specialty pharmaceuticals, said he sees the generic dispensing rate increasing to as much as 70 percent with the number of drugs coming off patent beginning in 2006.

The vast majority of top-selling branded drugs on the market today, representing a total of more than $50 billion in sales, currently are being challenged by generic drug makers.

Some of the blockbuster and super-blockbuster drugs coming off patent, however, represent the toughest generic markets in which to operate, with multiple competitors, aggressive pricing and the prospect of authorized generics, which can slice in half the profitability associated with the six-month exclusivity period for companies that successfully file Paragraph IV patent challenges.

According to Gary Buehler, the director of the Office of Generic Drugs, 569 abbreviated new drug applications were filed in 2004, up from 479 filed in 2003. In January, there were 55 ANDA receipts. If that trend continues, combined with a rising number of ANDAs filed per drug product, it potentially could equal 660 ANDAs filed in 2005--a rise of nearly 100 this year compared with 2004. The U.S. Food and Drug Administration also has chopped about a month off the approval time for generic drugs, meaning more generics will reach the market in less time.

While the combined factors seem like a positive for the industry, a rise in the number of foreign-based, low-cost producers is putting added pressures on generic drug makers operating in the United States.

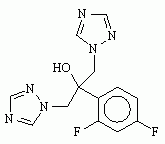

Indian drug firms, for example, can still make money in a crowded market when others cannot, evidenced by Dr. Reddy's and Ranbaxy, which both fared well in three of the most competitive markets in 2004, including the market for generic Diflucan. Ranbaxy gained the largest market share for the generic version of Pfizer's antifungal drug, with 24 percent share, compared with Greenstone, Pfizer's generic arm, which had 15 percent market share.

Capacity, including the amount and types of generic drugs produced, also becomes an issue for the industry. Drug makers competing in the active pharmaceutical ingredient business also are experiencing increased pressures because active pharmaceutical ingredients are getting cheaper to manufacture, and Chinese, Indian and Eastern European companies are increasing their capacity, further fueling competition on the U.S. market.

The fix? Industry consolidation, according to Banc of Americas Securities analyst David Marls, who said he sees more generic drug makers striking deals to get their products out the door, as well as more cooperation and alliances among generics players, including consolidation of U.S.- and non-U.S.-based companies. But deal cutting, while it gets generic drugs to market faster--a good thing for retailers and consumers--cuts margins and depresses profits for generic drug makers.

Another factor that could increase competition and pricing pressures, said Maris, is the possibility of outside players entering the market, such as a large pharmaceutical company or distributor.

Two hotly contested issues in the industry also will continue to impact generic drug makers, said Maris: citizen's petitions and authorized generics. He noted that citizen's petitions filed by branded drug makers as a way to keep generics from hitting the market are "nearly impossible to change."

Buehler, who along with Maris also presented data at the meeting, said the prospect "has got me losing sleep at night." FDA Commissioner Lester Crawford, who addressed GPhA members on the second day of the meeting, suggested that the FDA and GPhA form a joint task force to address the issue of citizen's petitions.

Maris, however, expressed doubt that there is an end in sight that would stop the practice of citizen's petitions or authorized generics. The practice, he said, offers branded drug makers a way to squeeze out marginal price players.

COPYRIGHT 2005 Reproduced with permission of the copyright holder. Further reproduction or distribution is prohibited without permission.

COPYRIGHT 2005 Gale Group