HAWTHORNE, N.Y. -- Taro Pharmaceutical Industries Ltd. ("Taro," the "Company," NASDAQ: TARO) today reported fourth quarter and full year results for 2004.

Fourth Quarter 2004 Results

Taro's fourth quarter sales were $77.7 million, compared with $88.6 million for the fourth quarter of 2003. Gross profit for the quarter was $42.3 million, compared with $62.1 million for the fourth quarter of 2003.

Selling, general and administrative ("SGA") expenses were $29.0 million, compared with $32.1 million for the year-ago quarter. R&D expenses were $9.2 million, compared with $11.1 million for the fourth quarter of 2003.

Net income for the quarter was $4.8 million, or $0.16 per diluted share, compared with $16.6 million, or $0.56 per diluted share, for the fourth quarter of 2003.

Sales in the United States continued to increase sequentially in the fourth quarter compared with the third and second quarters of 2004. Gross margin in the fourth quarter was affected by higher unit costs as the Company decreased production in line with the inventory reduction program initiated in the third quarter, and by price erosion, which is inherent in the generic pharmaceutical industry. Cost of goods was increased by several additional factors, including the decrease in value of the U.S. dollar, the cost of transferring production from the Company's Long Island, NY facility to its Toronto facility, and costs related to a reduction in manufacturing personnel.

The decrease in SGA expenses compared with the year-ago quarter and the third quarter of 2004 primarily reflects the cost reduction measures implemented by Taro in 2004. The decrease in net income compared with the year-ago quarter primarily results from the decrease in revenues, the increase in unit costs, changes in product mix, and price erosion.

Full Year 2004 Results

Taro's sales were $284.1 million for the year ended December 31, 2004, compared with sales of $315.5 million for 2003. Gross profit for 2004 was $164.7 million, compared with $213.0 million for 2003.

SGA expenses for the year were $123.4 million, compared with $97.7 million for 2003. R&D expenses were $41.9 million, compared with $40.6 million for 2003.

Net income for 2004 was $11.1 million, or $0.37 per diluted share, compared with $61.2 million, or $2.06 per diluted share, for 2003.

"Taro's performance in the second half improved compared to the first half of the year. Beginning in the first half of the year, Taro experienced an unexpected shortfall in U.S. sales at a time when the Company was undertaking a major initiative in the marketing of proprietary consumer products. These factors, combined with our continuing commitment to research, led to the decline in profits," said Barrie Levitt, M.D., Chairman of the Company. "Nevertheless, the improvement we witnessed in the second half came primarily from the corrective actions we took. Long-term, we continue to focus on the Company's prescription pharmaceutical business. We believe that our research and marketing initiatives, combined with our cost reduction measures, will return Taro to meaningful, sustainable and profitable growth."

Prescriptions for Taro products grew more than 19 percent in the United States in 2004, according to industry sources.

Balance Sheet

At December 31, 2004, Taro's total assets were $695.0 million, an increase of $78.5 million, compared with $616.5 million at December 31, 2003. Included in Deferred Taxes and Other Assets is the value of the Company's product acquisitions. Total liabilities were $326.2 million, an increase of $58.8 million, compared with $267.4 million at the end of 2003.

Shareholders' equity was $368.1 million at December 31, 2004, an increase of $20.7 million, compared with $347.4 million at the end of 2003.

Proprietary Research

T2000 is the first compound in a group of long-acting, non-sedating barbiturates under development at Taro. The Company is refining the study design for its Canadian Phase III trial of T2000 in essential tremor. There can be no assurance that T2000, or any members of its class, will be successful in any current or future clinical trials, or will be commercialized for any indication.

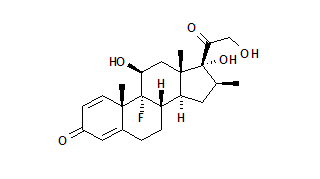

4th Quarter FDA Approvals and Generic Elocon(R) Supply Agreement

In the fourth quarter, Taro received final Abbreviated New Drug Application ("ANDA") approvals for five topical products: betamethasone dipropionate ointment (augmented), 0.05%, a generic version of Schering-Plough's Diprolene(R) ointment; halobetasol propionate ointment, 0.05%, a generic version of Bristol-Myers Squibb's Ultravate(R) ointment; hydrocortisone butyrate ointment, 0.1%, a generic version of Ferndale Laboratories' Locoid(R) ointment; and, mometasone furoate ointment, 0.1% and mometasone furoate cream, 0.1%, generic versions of Schering-Plough's Elocon(R) ointment and cream, respectively.

In December 2004, Taro entered into a supply agreement with Agis Industries (1983) Ltd. ("Agis") regarding the generic Elocon(R) cream product. As part of the agreement with Taro, Agis relinquished its right to 180-day generic exclusivity, permitting the FDA to grant final approval for Taro's ANDA. Under the agreement, Taro is supplying the product to Agis. An Agis subsidiary, Clay Park Labs, Inc., is distributing the product in the U.S.

U.S. FDA Filings

During 2004, Taro filed 10 ANDAs and received approvals for 15 ANDAs and one New Drug Application. Six of the ANDA approvals were for first-to-market generics. Taro currently has 27 filings submitted to the FDA: 26 ANDAs, including two tentative approvals, plus one NDA for a NonSpil(TM)-related product. Fourteen of the filings are for topical products and 13 are for products in oral and other dosage forms. The ANDAs address markets with annual U.S. sales of more than one billion dollars. In addition, Taro has regulatory filings in Canada, Israel and other countries.

Acquisition of New York Facility

In February 2005, Taro completed the acquisition of 3 Skyline Drive, the 124,000 square foot building in which the Company had initially acquired a 32% interest in 2002. The Company is consolidating its New York operations into this laboratory and office building.

Conference Call

The Company will conduct a conference call to discuss fourth quarter and year-end results on Thursday, February 24, 2005 at 11:00 a.m. Eastern Time (8:00 a.m. Pacific Time).

The call will be available live via the Internet by accessing www.taro.com.

Online and telephone replays of the call will be available from approximately 1:00 p.m. on February 24th through March 3, 2005. The online replay can be accessed at www.taro.com. The telephone replay can be heard by dialing 888-286-8010 (domestic U.S.) or +617-801-6888 (international) and providing the passcode 77052125 when prompted.

Taro is a multinational, science-based pharmaceutical company, dedicated to meeting the needs of its customers through the discovery, development, manufacturing and marketing of the highest quality healthcare products.

For further information on Taro Pharmaceutical Industries Ltd., please visit the Company's website at www.taro.com.

SAFE HARBOR STATEMENT

Certain statements in this release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements that do not describe historical facts and statements that refer or relate to events or circumstances the Company "believes" may happen. Although Taro Pharmaceutical Industries Ltd. believes the expectations reflected in such forward-looking statements to be based on reasonable assumptions, it can give no assurances that its expectations will be attained. Factors that could cause actual results to differ include general economic conditions, industry and market conditions, slower than anticipated penetration of new markets, changes in the Company's financial position, regulatory actions and legislative actions in the countries in which Taro operates, future demand and market size for products under development, marketplace acceptance of new or existing products, either generic or proprietary, and other risks detailed from time to time in the Company's SEC reports, including its Annual Reports on Form 20-F. Forward-looking statements speak only as of the date on which they are made. The Company undertakes no obligations to update, change or revise any forward-looking statement, whether as a result of new information, additional or subsequent developments or otherwise.

COPYRIGHT 2005 Business Wire

COPYRIGHT 2005 Gale Group