Although one-quarter of Rugged Traditionalists are women, this lifestyle is defined more by older men who value traditional, old-school gender roles: one-income families where the wife makes all the purchasing decisions for the pantry and the medicine cabinet.

The Rugged Traditionalist is your "typical manly man. They drink domestic beer. They watch football. They work on their cars. They come home from what's usually a blue-collar job to dinner on the table," remarked Kelly Sirimoglu, vice president of the brand strategy group at NOP World.

Rugged Traditionalists are about 51 years old--just beginning to experience the effects of aging, but still years away from retirement. And with a mean average household income of $59,000, they're more likely to be a Wal-Mart or Kmart core shopper, as the mass centers offer both value and a sports center where the Rugged Traditionalist can pick up his fishing and hunting equipment.

In fact, Rugged Traditionalists are as likely to bargain hunt down the automotives aisle as any health care aisle, though they'd be an ideal candidate for pain-relieving solutions for backaches and sore muscles with the amount of time they spend working on their late-model automobiles or sprucing up their back yards for summertime barbecues. Convenience food for a Rugged Traditionalist would consist of a bag of Lays potato chips, a ready-made dip mix and a cold six-pack of Budweiser.

They'd probably buy straight razors if they still sold them in drug stores. "They're very old fashioned in the products that they use and choose. This is the group that's buying aftershave at the drug store. They're buying hair tonics. They buy old brands--they don't like change," Sirimoglu noted. But they may be standing on the outer fringes of the metrosexual revolution-dabbling in men's care line extensions presented by core, traditional men's care brands.

"If you were to introduce a new product to appeal to them, you're really going to have your work cut out for you," Sirimoglu said. "But they'd probably be a great target for a line extension ... because they are so brand loyal for American brands and [venerable] brands. They can be a real foundation for companies that have [established] products."

For example, the introduction of Gillette's Complete Skincare in March, though definitely part of the current wave of men's skin care products, skews a bit older than other men's skin care lines' targeted demographic: the urban trendsetter. Gillette Complete Skincare promises to deliver an improved appearance within two weeks and revolves around a simple regimen of cleansing, shaving and moisturizing. Fast results and a simple regimen--ideal product attributes for the Rugged Traditionalist.

Rugged Traditionalists are great with numbers. They'd be able to recite Derek Jeter's career batting average; for instance (.314 at press time), or Peyton Manning's college completion percentage, perhaps (62.5%), or even the number of Nascar wins Rusty Wallace has under his belt (55, including one this year for sponsor Miller Lite).

Their ability to crunch numbers could translate into a checkstand opportunity for drug store operators. For example, in the heart of the Red Sox Nation, Brooks keeps a steady supply of BoSox paraphernalia on hand. Likewise, Shoppers Drug Mart fields plenty of Maple Leafs merchandise in Toronto--a town obsessed with hockey throughout the year.

"[Rugged Traditionalists] are most closely aligned with Nascar dads, except for their age," Sirimoglu said, because the average Nascar fan skews a little younger. But Rugged Traditionalists watch Nascar on television, they go to the racetracks in person, and they listen to it on the radio, she said.

Indeed, retailers and especially suppliers are using this group's love of the game to get their message out. It is in sports venues such as Nascar, Major League Baseball and the National Football League that pharmaceutical manufacturers are trying to reach a core, male-dominated market with their disease-state messages.

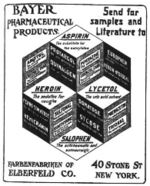

For instance, this year marks the first year that pharmaceutical companies purchased ad space during the Super Bowl, as GlaxoSmithKline and Bayer marketed the relatively new erectile dysfunction drug Levitra along with Lilly Icos' Cialis, another player in the ED category. Pfizer, which markets Viagra, didn't participate in this year's Super Bowl ad blitz, but the company has been a Nascar sponsor since 2000.

And Schering-Plough is largely credited with breaking down the sports marketing walls with the 1999 MLB marketing deal for then prescription-only allergy remedy Claritin.

Similarly, sports celebrities who have-come forward about their health conditions are making it easier for Rugged Traditionalists to broach the health care topics with their doctors.

Retired Pittsburgh Steelers quarterback and football analyst Terry Bradshaw is a spokesman for GlaxoSmithKline's antidepressant Paxil, as is Miami Dolphins running back Ricky Williams. Likewise, ex-Denver Bronco John Elway pitches Tap Pharmaceutical's Prevacid as a treatment for acid reflux, while pro basketball star Alonzo Mourning hawks Ortho Biotech's anemia remedy Procrit.

Hall-of-Fame San Francisco 49ers quarterback Joe Montana is a high-blood-pressure pitchman for Novartis, and basketball legend Magic Johnson serves up GlaxoSmithKline's Combivir as his HIV treatment of choice.

But Nascar still seems to resonate the most with Rugged Traditionalists, especially being as Nascar owes its roots to the "good ol' boys" of the South, a veritable bedrock for Rugged Traditionalists.

And according to a Nascar brand study, if given a choice between two products, 72 percent of Nascar fans would select a sponsor's product over a non-sponsor's product--a level of loyalty that at least matches that of a Rugged Traditionalist.

The one place you probably won't reach a Rugged Traditionalist is online. This consumer group is more likely to jump in the truck and shoot out to the convenience store, the drug store or the grocery store to pick up an item than to shop on the Internet.

And though their budget constraints would lead one to believe that value is the key driver in any purchase decision, judging from the shopping centers they visit, they seem to place greater importance on convenience. And that would mean that they fit the bill for the prototypical male consumer: They walk into a store not to shop, but to buy. They find and choose their product and then head for the checkstand.

That being the case, in-store signage at the shelf may be the best way to reach a Rugged Traditionalist to sway them possibly into making an unplanned purchase. Perhaps a clip-strip of single use samples of Tylenol 8 Hour strategically located in typical Rugged Traditionalist destination centers--chips and beer, for instance, or in the men's toiletry section.

Because they're active around the house and outdoors, other cross-promotional opportunities could exist between home and garden departments and topical analgesics, first-aid items or anti-itch products.

7-Eleven offers pit-stop appeal for the grab-and-go shopper

If Rugged Traditionalists are driven by convenience, then their shopping center of choice has to be 7-Eleven, with more than 2,500 products and services, many of them consumable items, packed into a selling space ranging from 2,400 square feet to 3,000 square feet.

7-Eleven banks so much on its ability to turn customers quickly and efficiently that many 7-Eleven parking lots have signs alerting consumers that they have 15 minutes to shop.

And that is music to Rugged Traditionalists' ears--make a quick pit stop at the local c-store, grab a pack of smokes and the beverage of choice, and it's on the road again.

What helps drive that convenience is the number of stores that can be clustered in any one area because a c-store only needs a small plot of land. Indeed, as of December 2003, there were more than 130,000 c-stores across the nation, and that store base continues to grow at a 10 percent clip. And 7-Eleven is leading the way. Operating in what is almost a $300 billion channel, 7-Eleven's store base across the United States and Canada totals more than 5,800 locations.

However, the convenience store industry faces its own channel-specific challenges. For example, gasoline sales are becoming more of a loss leader than a profit driver across the industry. At 7-Eleven, same-store sales of gasoline (measured in gallons)increased 8.8 percent in April.

Higher prices at the pump obviously are not stopping Rugged Traditionalists from streaming into the c-stores--indeed, the channel dominates in sales of tobacco and beverages--a pair of staple products for this blue-collar consumer group.

More than half of all non-alcoholic beverage sales in the convenience channel are carbonated soft drinks, followed by juice drinks, water and sports drinks. And as the industry moves toward more food service sales, providing an additional point of convenience for Rugged Traditionalists, beverage sales are expected to grow, as well.

Of all U.S. retailers, 7-Eleven sells the most USA Today newspapers and Sports Illustrated magazines, the most cold beer, the most fresh-grilled hot dogs and the most single-serve chips. In any given four-week period, loyal convenience store consumers visit a 7-Eleven store an average of 17 times. And nearly one-third of the 6 million people who stop by a 7-Eleven store each day purchase immediately consumable food.

Drug's best buy: beer and smokes

When Rugged Traditionalists drop by their local convenience marts--be it traditional convenience stores or conveniently positioned drug store retailers--chances are they're there to stock up on beer and tobacco products.

And though that may not be the healthiest of product selections, those two product categories alone represent almost $3.5 billion in annual drug store sales, according to ACNielsen. Of course, convenience store sales in those two categories dwarf anything that the drug channel can muster: $56 billion, some 16 times more than the drug channel. Indeed, tobacco and beer sales represent the two largest product categories in the convenience channel--making Rugged Traditionalists valuable c-store customers, as they index very high in both beer and tobacco product purchases.

Comparatively, convenience stores are generating an average of $430,000 per store per year to the drug store average of $90,000 per store in these two categories.

According to a National Association of Convenience Stores 2004 State of the Industry report, convenience stores are grabbing cigarette market share from food, drug and mass, enabling c-stores to grow share despite increased pressure from value-positioned Internet and mail order merchants. Likewise, convenience stores have been growing beer sales despite the fact that only 70 percent of convenience store chains sell beer, compared with 75 percent in 2002.

Needless to say, there are plenty of growth opportunities in both tobacco and beer sales for drug store operators that choose to cater to Rugged Traditionalists.

And cater they should.

Demographically speaking, the drug channel beer consumer matches up very well with the Rugged Traditionalist. According to Anheuser-Busch research, two-thirds of drug store beer purchasers are male, almost half of them are over age 45, and the majority are high school graduates in a blue-collar line of work. Beer sales make up a little more than $1 billion annually across the drug channel, com pared with almost $13 billion in c-stores.

Likewise, the drug store tobacco consumer cannot be ignored. Tobacco continues to be the drug channel's No. 1 front-end category despite the fact that the health risks associated with tobacco use certainly don't mesh with the healthy-living message associated with the pharmacy.

Tobacco sales continue to be on the downslide as older users are pressed by their doctors to quit and the tobacco industry is shackled by government regulators in attracting new consumers. Drug stores are best positioned as a destination center for customers when they do decide to quit. CVS positions its smoking-cessation products behind the same counter where cigarettes are merchandised.

COPYRIGHT 2004 Reproduced with permission of the copyright holder. Further reproduction or distribution is prohibited without permission.

COPYRIGHT 2004 Gale Group