If recent launches from three analgesic tablet suppliers are any indication, the pain relief category continues to go the way of the cough-cold business, which has been reapportioned in recent years to favor a more condition-specific assortment, with products categorized by symptom.

Of course, introducing condition-specific pain-relief to the analgesic aisle isn't new--suppliers started targeting such pain states as arthritis and migraine a few years ago. But as sales of OTC arthritis and migraine tablets plateau, suppliers are turning to pain conditions that will bring more sufferers to the table: muscle aches and pains and tension headaches.

The thinking goes that consumers will purchase one pain reliever for their back pain, another for their muscle discomfort and possibly will keep a tension remedy on hand for those times they have a headache--turning one purchase incidence into several drug store trips.

And the sales figures bear this out.

Although the second-largest drug store category has grown only 1.9 percent in the 52 weeks ended Sept. 7 to $900.8 million in drug, according to Information Resources Inc., sales in the core brands are down slightly. The current sales trends suggest that perhaps the newer muscle pain and tension headache, remedies are taking a small part of the business away from established migraine and arthritis pain treatments.

While this may sound like bad news for analgesic suppliers whose flagship brands--namely Tylenol, Advil and Excedrin--are experiencing flagging sales, it's actually driving growth in the category. Growth of 1.9 percent translates to $16.8 million in incremental dollars in drug stores for the one-year period ended the first week of September. About half of that came from two new condition specific brands--Tylenol 8 Hour and Excedrin Tension Headache, which together rang up sales of more than $8 million in drug stores--in less than a full year on the shelf. That eases some of the pain associated with lost sales to the core brands.

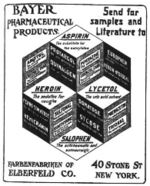

"There is definitely a trend toward more specific SKUs, which help consumers in identifying the right product for their condition," commented Michaela Griggs, category director at Bayer Consumer Care. "U.S. households usually carry multiple analgesic brands, which indicates that consumers already rely on various pain relievers for different pain states."

In April, McNeil Consumer Healthcare introduced its Tylenol 8 Hour to reach a broader consumer base than its Tylenol Arthritis Pain brand could. The technology that provides the extended pain relief is similar in both McNeil products. However, a McNeil spokeswoman noted that because of its name, the arthritis brand "has been virtually untouched by consumers under 45 and those with non-arthritic pain."

Bristol-Myers Squibb launched its Excedrin Tension Headache formulation in June in an attempt to reach the 93 percent of Americans stressed out enough to experience tension headaches. "As Americans become more health conscious, they are also becoming more aware of the causes and symptoms of their headache pain," stated Michael Gallagher, director of the University Headache Center at the University of Medicine and Dentistry of New Jersey.

While sales figures for Bayer's Extra Strength Bayer Back & Body Pain were not available, according to Griggs, in the one-year period following its May 2002 introduction, "1.6 percent of U.S. households purchased Bayer Back & Body," she said. "Of these households, more than 21 percent made at least one repeat purchase during that time."

COPYRIGHT 2003 Reproduced with permission of the copyright holder. Further reproduction or distribution is prohibited without permission.

COPYRIGHT 2003 Gale Group