In the coming year, pharmacists may be making over-the-counter recommendations for two entirely new self-care categories, while the stage may be set for the introduction of a new nonprescription alternative for the diet aid set in 2006.

It was expected in mid-January that a pair of Food and Drug Administration advisory committees would make recommendations on the switch proposal of Johnson & Johnson/ Merck's Mevacor 20 mg.

If the committees recommend not to switch, any chance that statins become an OTC staple one day will be pretty slim. But if those advisory committees vote in favor of an OTC statin, the experts are split on whether this country actually will witness a statin conversion from the prescription market to OTC in the end. Bristol-Myers Squibb and Bayer both believe a statin switch is likely, and the companies are expected to move on their joint switch of Pravachol if the advisory committees vote in favor of Mevacor.

The most compelling arguments against a statin switch are still the safety profile of chronic use and the actual use in an OTC environment of a drug indicated for treating a nonsymptomatic disease state. J&J/Merck ought to be able to justify the safety profile of a low-dose Mevacor, and the company has data from its Zocor HeartPro statin switch in the United Kingdom to draw upon.

Patients in which high cholesterol has been identified as a problem are not the target market for OTC statins--their doctors are prescribing more powerful, higher-dose prescription statins. The market for OTC statins are those consumers who recognize they belong to a high cholesterol risk group, smokers for example, but who are not being treated by a physician for high cholesterol. Therefore, selling statins over-the-counter is likely to happen before the year is over, but it may not generate the dollar windfall many entirely new OTC categories produce when first introduced, judging from Zocor HeartPro's performance. An OTC statin creates a category for which there are no physical symptoms to relieve, so it may be a tough sell for the consumer.

A consumer survey from the National Lipid Association found that more than half of all respondents at moderate risk of high cholesterol expressed strong interest in an OTC statin. However, 83 percent suggested they would talk with their doctors before buying that OTC statin, and if there is a real cholesterol issue there, that doctor is more likely to prescribe a better-performing prescription statin.

This week, the FDA is expected to decide on Barr Laboratories amended switch application of the emergency contraceptive Plan B. The FDA initially rejected Barr's switch application because not enough data was collected in pediatric (read: teen) use. Barr's new application prohibits the sale of Plan B to women younger than 16.

While the issue of making an emergency contraceptive available over-the-counter is politically charged, Plan B is expected to do much better as a nonprescription option. Because the drug must be taken within 48 hours of sexual intercourse to prevent pregnancy, immediate access is an issue.

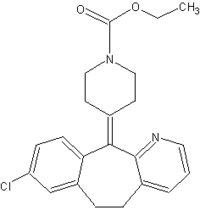

Later this year, GlaxoSmithKline is expected to file a switch application for orlistat, Roche's prescription weight-loss remedy Xenical. However, a history of adverse side effects, such as gas and oily stools, and new Rx competition could limit Orlistat's OTC potential. Such adverse side effects and the potential launch of Acomplia, a potential blockbuster prescription-only weight loss drug expected to launch in 2006, may restrict the market potential of orlistat as an OTC product.

COPYRIGHT 2005 Reproduced with permission of the copyright holder. Further reproduction or distribution is prohibited without permission.

COPYRIGHT 2005 Gale Group