HAWTHORNE, N.Y. -- Taro Pharmaceutical Industries Ltd. ("Taro," the "Company," Nasdaq: TARO) today reported results for the Company's third quarter and the nine-month period ended September 30, 2005.

Third Quarter 2005 Results

Taro's third quarter sales were $72.5 million, compared with $73.3 million in the third quarter of 2004. Sales in the third quarter of 2004 included the contribution from proprietary over-the-counter ("OTC") product lines, which were divested earlier this year. Gross profit for the quarter was $37.7 million, compared with $42.5 million in the third quarter of 2004.

Selling, general and administrative expenses ("SG&A") were $22.3 million, compared with $29.6 million in the year-ago quarter. The decrease in SG&A reflects a reduction of marketing expenses following the above mentioned divestiture of the Company's proprietary OTC product lines and the Company's continuing focus on expense control. R&D expenses were $11.7 million, compared with $10.5 million for the third quarter of 2004.

Operating income was $3.7 million, compared with $2.4 million for the year-ago quarter. Net income for the quarter was $2.1 million, or $0.07 per diluted share, compared with net income of $4.0 million, or $0.14 per diluted share, for the third quarter of 2004.

Accounting Treatment Revised for ElixSure(R) and Kerasal(R) Divestiture

In March 2005, the Company reported that it had entered into multi-year agreements to divest its over-the-counter ElixSure(R) and Kerasal(R) products in North America. Pursuant to the terms of the agreements, including the sale of inventories, the Company received $10 million in cash in the first quarter. Among other matters, the agreements provide for additional payments to be made to Taro in each of the next three years.

The Company accounted for the initial $10 million payment by recording the sale of inventories of approximately $4.9 million in the first quarter, and deferring the remaining $5.1 million, as well as all other revenues to be recognized over the ensuing three-year contract period. The Company has reconsidered the timing of revenue recognition for a portion of the $4.9 million in sales in the first quarter and accordingly revised the accounting treatment to allocate that portion over the three-year contract period. This change did not have any effect on the Company's cash position. The change will reduce revenue and net income in the first quarter of 2005 by $4.8 million and $1.2 million respectively, and allocate the amount of the reduction in revenue and net income over the three-year contract period. In the second quarter, revenue was increased by $0.4 million and net income by $0.1 million. The results of the third quarter and the nine months reflect these changes.

Nine Month Results

Sales were $225.3 million for the nine-month period ended September 30, 2005, compared with $206.5 million for the same period in 2004. The Company's gross profit in the nine-month period was $123.0 million, compared with $122.4 million for the same period in 2004.

SG&A expenses for the nine-month period were $72.1 million, compared with $94.4 million for the year-ago period. R&D expenses were $33.3 million for the first nine months of this year, compared with $32.7 million in the year-ago period.

Operating income for the nine-month period was $17.7 million, compared with an operating loss of $4.7 million for the year-ago period. Net income for the nine-month period was $12.6 million, or $0.42 per diluted share, compared with net income of $6.3 million, or $0.21 per diluted share, for the first nine months of 2004.

Discussion of Third Quarter Results

The results for the third quarter of 2005 were affected by various factors, including price erosion, an increase in production costs resulting from the strengthening of the Canadian dollar against the U.S. dollar, and the mix of products sold.

In the third quarter of 2005, according to industry sources, total prescriptions for Taro products increased approximately 8% compared with the third quarter of 2004 and approximately 3% from the second quarter of 2005.

Sales were reduced from $79.0 million in the second quarter of 2005 to $72.5 million in the third quarter, while prescriptions for the Company's products increased. "The increase in prescriptions and the decrease in sales suggest a reduction in customer inventories," said Bill Seiden, Senior Vice-President of Sales and Marketing.

Financial Position

At September 30, 2005, Taro's total assets were $710.2 million, an increase of $13.4 million compared with $696.8 million at December 31, 2004.

Total liabilities were $325.4 million at September 30, 2005, a decrease of $2.6 million compared with $328.0 million at the end of 2004.

Shareholders' equity at September 30, 2005 was $384.1 million, an increase of $16.0 million compared with $368.1 million at the end of 2004.

"Our results reflect the competitive nature of the generic drug industry and our continuing investment in the development of proprietary and generic drugs," said Barrie Levitt, M.D., Chairman of the Board. "We believe that Taro has a robust pipeline which includes the critical products necessary to sustain the long-term growth of our generic business. In addition, two of our major proprietary research initiatives are approaching definitive clinical studies."

Proprietary Research Update

Novel Formulation of Ovide(R)

On October 26, 2005, the Company announced that it will initiate a multi-center Phase III study in the United States to evaluate a novel formulation of Ovide(R), a prescription product for control of head lice (Pediculus humanus capitis) in pediatric and adult subjects.

Taro Pharmaceuticals U.S.A., Inc. currently markets Ovide(R) (malathion) Lotion, 0.5%. The Company expects that the new formulation of Ovide(R) will maintain the efficacy of Ovide(R) Lotion with shorter application time and greater ease of use, thus improving patient compliance. Approximately six to twelve million cases of head lice are reported annually in the United States, according to the American Academy of Pediatrics. Taro has filed a patent application in the U.S. Patent and Trademark Office with claims that cover this new, proprietary formulation.

There can be no assurance as to the successful outcome of any studies of the novel formulation of Ovide(R), or of its eventual approval by any regulatory authorities or successful commercialization if approved.

T2000 Studies

T2000 is the first compound in a group of long-acting, non-sedating barbiturates under development at Taro. As reported earlier, the Canadian Health Products and Food Branch Inspectorate has approved a multi-center, randomized, double-blind, placebo-controlled Phase III study of T2000 in patients with essential tremor. Essential tremor is a common form of involuntary shaking not related to Parkinson's disease. It is estimated that essential tremor affects more than five million people in the U.S. To date, T2000 has been administered to 165 people in Phase I and II studies to evaluate the compound's safety and efficacy.

There can be no assurance of the ultimate demonstration of safety and efficacy, or successful completion of Phase III testing, or of the approval by any regulatory authority of T2000 for any indication, or of its commercial success if and when approved.

FDA Approvals

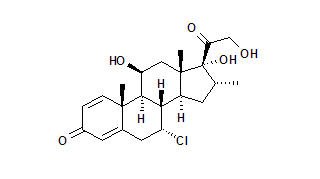

During the third quarter, the Company reported that five final approvals were received from the U.S. Food and Drug Administration ("FDA") for Abbreviated New Drug Applications ("ANDAs") for topical generic pharmaceutical products. Three are prescription corticosteroids used in treating inflammatory skin conditions: Hydrocortisone Butyrate Cream USP, 0.1%, bioequivalent to Ferndale Laboratories' Locoid(R) cream; Halobetasol Propionate Cream, 0.05%, bioequivalent to Bristol-Myers Squibbs' Ultravate(R) cream; and Alclometasone Dipropionate Cream USP, 0.05%, bioequivalent to GlaxoSmithKline's Aclovate(R) cream. Two are prescription products used in treating infections of the skin: Ciclopirox Topical Suspension USP, 0.77%, an antifungal product, which is bioequivalent to Medicis Pharmaceutical Corp.'s Loprox(R) Topical Suspension; and, Mupirocin Ointment USP, 2%, an antibiotic used to treat impetigo. This product is bioequivalent to GlaxoSmithKline's Bactroban(R) Ointment.

In addition, during the quarter, Taro received tentative approval from the FDA of its ANDA for Gabapentin Capsules 100 mg, 300 mg, and 400 mg. Tentative approvals do not grant marketing rights. On October 4, 2005, Taro received FDA approval of its New Drug Application for Loratadine Oral Suspension, 5mg / 5mL. This spill-resistant OTC product, used for the temporary relief of symptoms due to upper respiratory allergies, utilizes the proprietary NonSpil(R) liquid drug delivery system developed by Taro researchers.

FDA Filings

Currently, Taro has 25 ANDA filings at the FDA, including four tentative approvals. These filings address U.S. markets with annual sales of more than $1 billion. In addition, Taro and its affiliates have regulatory filings in Canada, Israel and other countries.

Conference Call

The Company will conduct a conference call to discuss third quarter and nine-month results on Thursday, November 17, 2005 at 11:00 a.m. Eastern Time (8:00 a.m. Pacific Time). The call will be available live via the Internet by accessing www.taro.com. An online replay will be available through November 25, 2005 on www.taro.com. A telephone replay will also be available through November 25, 2005 by dialing 1-888-286-8010 (domestic U.S.) or +617-801-6888 (international) and providing the passcode 69447933.

Taro Pharmaceutical Industries Ltd. is a multinational, science-based pharmaceutical company dedicated to meeting the needs of its customers through the discovery, development, manufacturing and marketing of the highest quality healthcare products. For more information on the Company, please visit www.taro.com.

SAFE HARBOR STATEMENT

Certain statements in this release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements that do not describe historical facts, statements that include the words "hope," "will," "believe," "suggest," "anticipate," "expect," "plan," "intend," or "design" to happen or exist, or similar language; and statements concerning the Company's sales and profitability, the impact of strategic initiatives, customer inventory levels, cost reductions, studies of Ovide(R) and T2000, recently approved products, the market environment, and the market size of the Company's pipeline. Although the Company believes that such statements are based on reasonable assumptions and reliable sources, it has no assurance thereof. Factors that could cause actual results to differ include general economic conditions, industry and market conditions, changes in buying patterns by any of the Company's customers, the ability of third parties to execute their agreements with Taro successfully, regulatory actions and legislative actions in the countries in which Taro operates, future demand and market size for products under development, marketplace acceptance of new or existing products, either generic or proprietary, and other risks detailed from time to time in the Company's SEC reports, including its Annual Reports on Form 20-F. On an ongoing basis, the Company reviews (and, if appropriate, revises) its estimates, including those related to reserves for customer charge-backs, bad debts, income taxes and contingencies. The Company bases its estimates on currently available information, historical experience and various other assumptions that it believes to be reasonable under circumstances prevailing from time to time. The results of these assumptions are the basis for determining the carrying values of assets and liabilities that are not readily apparent from other sources. Since the factors underlying these assumptions are subject to change over time, the estimates on which they are based are subject to change accordingly. Forward-looking statements speak only as of the date on which they are made. The Company undertakes no obligations to update, change or revise any forward-looking statement, whether as a result of new information, additional or subsequent developments or otherwise.

COPYRIGHT 2005 Business Wire

COPYRIGHT 2005 Gale Group