HAWTHORNE, N.Y. -- Taro Pharmaceutical Industries Ltd. ("Taro," the "Company," Nasdaq: TARO) today reported results for the Company's third quarter and the nine-month period ended September 30, 2004.

Third Quarter 2004 Results

Taro's third quarter sales were $73.3 million, compared with $83.1 million in the third quarter of 2003. Gross profit for the quarter was $42.5 million, compared with $56.6 million in the third quarter of 2003.

Selling, general and administrative ("SGA") expenses were $29.6 million, compared with $25.7 million in the year-ago quarter. R&D expenses were $10.5 million, compared with $11.2 million for the third quarter of 2003.

Net income for the quarter was $4.0 million, or $0.14 per diluted share, compared with net income of $15.7 million, or $0.53 per diluted share, for the third quarter of 2003.

"The increase in sales in the third quarter compared with the second quarter was a major factor in Taro's return to profitability," said Barrie Levitt, M.D., Chairman of the Company. "While revenues in the third quarter were lower than a year ago, the sequential increase in quarterly revenues reflected improvements in sales to all classes of trade in the United States. Although sales to U.S. wholesalers remained below year-ago levels, they improved compared with the second quarter."

According to industry sources, overall prescriptions for Taro products in the United States increased in the third quarter compared with the same period last year.

Nine Month Results

Sales were $206.5 million for the nine-month period ended September 30, 2004, compared with $226.8 million for the same period in 2003. The Company's gross profit in the nine-month period was $122.4 million, compared with $150.9 million for the same period in 2003.

SGA expenses for the nine-month period were $94.4 million, compared with $65.6 million for the year-ago period. R&D expenses were $32.7 million for the first nine months of this year, compared with $29.5 million in the year-ago period.

Net income for the nine-month period was $6.3 million, or $0.21 per diluted share, compared with net income of $44.5 million, or $1.50 per diluted share, for the first nine months of 2003.

Financial Position

At September 30, 2004, Taro's total assets were $659.8 million, an increase of $43.3 million compared with $616.5 million at December 31, 2003. Included in Other Assets and Deferred Taxes are the Company's in-licensing agreements and product acquisitions. Total liabilities were $301.7 million, an increase of $34.3 million compared with $267.4 million at the end of 2003.

Shareholder's equity was $357.3 million at September 30, 2004, an increase of $9.9 million compared with $347.4 million at the end of 2003.

"We believe that several initiatives undertaken in the third quarter of this year will continue to have a positive impact on Taro's performance in future quarters. These initiatives include a focus on decreasing inventories; a reduction in purchasing and production; rationalization of manufacturing operations, and the deferral of non-core initiatives," said Dr. Levitt. "In addition, we are lowering Taro's expense profile, which has included a reduction in Taro's workforce of approximately 150 people, or ten percent."

Proprietary Research

T2000 is the first compound in a group of long-acting, non-sedating barbiturates under development at Taro. Following its review of Phase I and Phase II studies on T2000, the Canadian Health Products and Food Branch Inspectorate has approved a multi-center, randomized, double-blind, placebo-controlled Phase III study of T2000 in patients with essential tremor.

The Company is continuing its preparations for definitive studies in Canada on the safety and efficacy of T2000. There can be no assurance that T2000, or any members of its class, will be successful in any current or future clinical trials, or will be commercialized for any indication.

ANDA Approvals

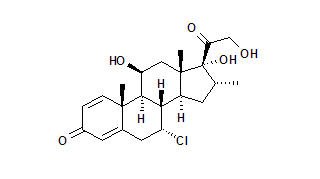

During the third quarter, approvals were received from the FDA for four Abbreviated New Drug Applications ("ANDAs") for generic pharmaceutical products.

Two of the approvals are for topical products used in dermatology: clotrimazole and betamethasone dipropionate lotion (bioequivalent to Schering-Plough's Lotrisone(R) lotion) and alclometasone dipropionate ointment (bioequivalent to GlaxoSmithKline's Aclovate(R) ointment). Taro Pharmaceuticals U.S.A., Inc. ("Taro USA") now provides the U.S. market with a generic equivalent of Lotrisone(R) in both cream and lotion forms.

The other approvals are for oral dosage form products: fluconazole tablets in 50, 100, 150 and 200 mg strengths (bioequivalent to Pfizer's Diflucan(R) tablets), and loratadine syrup, 5 mg/5 mL (bioequivalent to Schering-Plough's Claritin(R) syrup).

To date in the fourth quarter, approvals were received for two additional ANDAs. An ANDA approval was received for augmented betamethasone dipropionate ointment, which is bioequivalent to Schering-Plough's Diprolene(R) ointment. Taro also received approval of its ANDA for ciprofloxacin tablets in 250, 500 and 750 mg strengths, bioequivalent to Bayer's Cipro(R) tablets in the same strengths, and a tentative ANDA approval for the 100 mg strength.

As previously announced, Taro USA has entered into an agreement with Medicis Pharmaceutical Corporation to license four dermatologic products for the U.S. and Canada with a purchase option. Two of the products, Lustra(R) and Lustra-AF(R), used for the treatment of dyschromia or discoloration of the skin, are currently being marketed to dermatologists across the United States by Taro's professional medical representatives.

FDA Filings

Currently, Taro has 25 filings at the FDA. These consist of 24 ANDAs, plus one New Drug Application related to the Company's NonSpil(TM) liquid drug delivery system. The ANDAs address U.S. markets with annual sales of more than $1 billion. In addition, Taro and its affiliates have regulatory filings in Canada, Israel and other countries.

Conference Call

The Company will conduct a conference call to discuss third quarter and nine-month results on Thursday, October 28, 2004 at 11:00 a.m. Eastern Time (8:00 a.m. Pacific Time). The call will be available live via the Internet by accessing www.taro.com. An online replay will be available through November 4, 2004 on www.taro.com. A telephone replay will also be available through November 4, 2004 by dialing 1-888-286-8010 (domestic U.S.) or +617-801-6888 (international) and entering the passcode 28430887 when prompted.

Taro Pharmaceutical Industries Ltd. is a multinational, science-based pharmaceutical company dedicated to meeting the needs of its customers through the discovery, development, manufacturing and marketing of the highest quality healthcare products.

SAFE HARBOR STATEMENT

Certain statements in this release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements that do not describe historical facts, and statements that include the words "hope," "will," "believe," "anticipate," "expect," "plan," "intend," or "design" to happen or exist, or similar language, and statements concerning the Company's sales and profitability, the impact of strategic initiatives and cost reductions on future performance, studies of T2000, and the market size of the Company's pipeline. Although the Company believes that such statements are based on reasonable assumptions and reliable sources, it has no assurance thereof. Factors that could cause actual results to differ include general economic conditions, industry and market conditions, changes in buying patterns by any of the Company's customers, regulatory actions and legislative actions in the countries in which Taro operates, future demand and market size for products under development, marketplace acceptance of new or existing products, either generic or proprietary, and other risks detailed from time to time in the Company's SEC reports, including its 2003 Annual Report on Form 20-F. On an ongoing basis, the Company reviews (and, if appropriate, revises) its estimates, including those related to reserves for customer charge-backs, bad debts, income taxes and contingencies. The Company bases its estimates on currently available information, historical experience and various other assumptions that it believes to be reasonable under circumstances prevailing from time to time. The results of these assumptions are the basis for determining the carrying values of assets and liabilities that are not readily apparent from other sources. Since the factors underlying these assumptions are subject to change over time, the estimates on which they are based are subject to change accordingly. Forward-looking statements speak only as of the date on which they are made. The Company undertakes no obligations to update, change or revise any forward-looking statement, whether as a result of new information, additional or subsequent developments or otherwise.

Financial Tables Follow:

COPYRIGHT 2004 Business Wire

COPYRIGHT 2004 Gale Group