Third Quarter Highlights:

- Total Product Sales for the Third Quarter Reached a Record $113.9 Million, 36% Increase Year-Over-Year

- Commercial Team Finalized Preparations for REVLIMID(R) Launch As First Oral Targeted Therapy For Low To Intermediate-1-Risk MDS Patients With Deletion 5q Chromosomal Abnormality

- FDA Oncologic Drugs Advisory Committee Recommended REVLIMID for Full Approval, by a 10-5 vote, As Oral Targeted Therapy For Low To Intermediate-1-Risk MDS Patients With Deletion 5q Chromosomal Abnormality; PDUFA Date Extended to January 7, 2006

- REVLIMID Marketing Authorization Application (MAA) Accepted by the EMEA to Evaluate REVLIMID as Oral Targeted Therapy for Treatment of Patients with Myelodysplastic Syndromes (MDS) with Deletion 5q Chromosomal Abnormality

- REVLIMID Phase III Study in Low and Intermediate Risk MDS Patients with Deletion 5q Chromosomal Abnormality Enrolling Rapidly in Europe

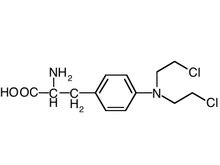

- Significant Number of Presentations on Clinical Data for REVLIMID(R), THALOMID(R), ACTIMID(TM), ALKERAN(R) as Single Agents and in Combination Therapies Accepted at The American Society of Hematology 47th Annual Meeting in Atlanta (December 9-13, 2005)

- REVLIMID First Peer-Reviewed Publication on Newly Diagnosed Multiple Myeloma in Journal BLOOD

- Celgene Provided Financial Support for Charitable Foundation to Help Patients Obtain Access to Innovative Therapies

- Celgene 2005 Analyst/Investor Day Event Starting at 8:30 a.m. EST, Access to Webcast Available at www.celgene.com

- Celgene Management Team Further Strengthened by the Addition of Mr. Aart Brouwer as President of Celgene International, Sarl

2005 Financial Guidance Update:

- Total Revenue Target Increased to $535 Million Range from $525 Million Range

- R&D Expenditures Target Increased to $200 Million Range from $190 Million Range to Support Accelerated REVLIMID Global Regulatory and Clinical Initiatives

- SG&A Expenditures Target Increased to $175 Million Range to Include Approximately $30 to $35 Million to Support Pre-Launch Activities for REVLIMID

- Excluding Any Potential REVLIMID Revenue and Launch Expenses Expected to Total Approximately $30 to $35 Million in 2005, Adjusted Earnings Per Diluted Share Target Affirmed to Achieve $0.55 Range

SUMMIT, N.J., Nov. 3 /PRNewswire-FirstCall/ -- Celgene Corporation announced adjusted earnings per diluted share of $0.06 for the quarter ended September 30, 2005. On a reported basis, under U.S. Generally Accepted Accounting Principles (GAAP), Celgene reported net income of $668.0 thousand compared to net income of $19.0 million, or earnings of $0.11 per diluted share in the third quarter of the prior year. Total product sales for the third quarter increased 35.9 % to $113.9 million from $83.8 million for the prior-year quarter. THALOMID(R) net sales in the third quarter of 2005 increased 25.9% to $99.1 million from $78.7 million in the third quarter of 2004. Celgene posted third quarter adjusted net income of $10.4 million, or adjusted earnings of $0.06 per diluted share compared to adjusted net income of $21.2 million or adjusted earnings of $0.12 per diluted share in the third quarter of last year.

For the nine-month period, total product sales reached a record $316.9 million, an increase of 32.6% over the same period in 2004. THALOMID sales for the nine-month period were $281.9 million compared to $222.5 million in 2004, an increase of 26.7% year-over-year. Celgene posted adjusted net income of $60.1 million or adjusted earnings of $0.33 per diluted share, during the nine-month period, compared to adjusted net income of $42.2 million or adjusted earnings of $0.24 per diluted share in the comparable 2004 period. During the nine-month period on a reported basis, Celgene announced GAAP net income of $59.7 million or earnings of $0.33 per diluted share, compared to GAAP net income of $30.5 million or earnings of $0.17 per diluted share in the nine-months of last year.

Adjusted net income and per share amounts for the three and nine-month periods ended September 30, 2005, eliminate the effects of charges for accelerated depreciation expense related to the Company's corporate headquarters relocation, charges to record our share of equity losses in EntreMed, Inc. and to adjust the income tax provision to a projected cash tax rate of 28.0 percent. Adjusted net income and per share amounts for the nine-month period ended September 30, 2005, also excludes the effects of charges recorded for changes in the estimated value of the Company's investment in EntreMed, Inc. warrants which were exercised on March 31, 2005.

Adjusted or Non-GAAP financial measures provide investors and management with supplemental measures of operating performance and trends that facilitate comparisons between periods before, during and after certain items that would not otherwise be apparent on a GAAP basis because certain unusual or non-recurring items that do not affect the Company's basic operations also do not meet the GAAP definition of unusual non-recurring items. Adjusted earnings are not, and should not be, viewed as a substitute for GAAP net income. Our definition of adjusted earnings may differ from others.

To support clinical development and to advance U.S. and European regulatory filings, Celgene increased R&D expenditures in REVLIMID(R) regulatory programs in myelodysplastic syndromes and multiple myeloma. Celgene incurred R&D expenses of $49.3 million in the third quarter of 2005, representing an increase of 22.9% compared to the year ago quarter. These R&D expenditures are expected to increase in the fourth quarter in support of our ongoing global regulatory filings, late stage clinical trials, clinical progress in multiple proprietary development programs and related clinical manufacturing costs.

Selling, general and administrative expenses were $46.9 million in the third quarter of 2005, driven primarily by higher marketing and sales expenses related to product launch activities. Approximately $13 million, or approximately $0.07 per diluted share, in marketing and sales expenses were spent to support pre-launch activities for REVLIMID. These marketing and sales expenditures are expected to increase in the fourth quarter 2005 as Celgene optimizes its commercial launch preparations.

As of September 30, 2005, Celgene reported $746.0 million in cash and marketable securities, an increase of $22.3 million versus the prior quarter.

"We are pleased with the progress of our REVLIMID regulatory application for MDS in the U.S. and Europe achieved during the third quarter," said John W. Jackson, Chairman and Chief Executive Officer of Celgene Corporation." Our commercial preparations are being finalized to ensure rapid access to REVLIMID upon approval."

Celgene will webcast its third quarter 2005 operating and financial results on November 3, 2005 starting at 8:00 a.m. EST, and its 2005 Analyst/Investor Day program starting at 8:30 a.m. EST. The webcast will be available at http://www.celgene.com/. A replay of the event will be available from noon EST November 4, 2005 until midnight EST November 17, 2005. To access the audio replay, dial 1-888-286-8010 and enter Reservation Number 22719360.

About Celgene

Celgene Corporation, headquartered in Summit, New Jersey, is an integrated global biopharmaceutical company engaged primarily in the discovery, development and commercialization of novel therapies for the treatment of cancer and inflammatory diseases through gene and protein regulation. For more information, please visit the Company's website at http://www.celgene.com/.

This release contains forward-looking statements which are subject to known and unknown risks, delays, uncertainties and other factors not under the Company's control, which may cause actual results, performance or achievements of the Company to be materially different from the results, performance or other expectations expressed or implied by these forward-looking statements. These factors include results of current or pending research and development activities, actions by the FDA and other regulatory authorities, and other factors described in the Company's filings with the Securities and Exchange Commission such as our 10-K, 10-Q and 8-K reports.

CONTACT: Robert J. Hugin, Senior VP and CFO of Celgene Corporation, +1-908-673-9102, or Brian P. Gill, Director of PR/IR, +1-908-673-9530, both of Celgene Corporation

Web site: http://www.celgene.com/

COPYRIGHT 2005 PR Newswire Association LLC

COPYRIGHT 2005 Gale Group