Assume there's a leaky faucet in the kitchen. It's dripping underneath the sink and causing an awful mess. Do you.

A. Soak up the excess water, ignore the source of the problem and clean it up again in a few hours?

B. Wait until the water has leaked out and then turn off the water supply?

C. Turn off the water supply before it ever leaks on the floor?

Obviously, C is the correct answer in this example. It is also the correct answer when one is trying to capture market share as an H2 blocker. Using an H2 blocker to shut off production of excess stomach acid before heartburn strikes is an easy decision for consumers to make. Marketers of H2 blockers know this and recognize their products, strongest selling point is clearly heartburn prevention.

Axid at the ready

Whitehall-Robins will leverage aggressively the prevention indication with Axid AR. This brand's success will rest on a highly focused strategy that emphasizes Axid. AR's ability to not only prevent but "completely prevent" heartburn.

Clinical studies demonstrate that in a significant number of people (15 percent), one 75-mg tablet of Axid AR prevented heartburn completely. Whitehall-Robins can be expected to hammer that point into the minds of consumers because at this point other H2 brands don't make competitive claims regarding their gradiation of symptom abatement. This is a fancy way of saying Axid AR works better than other H2s, an advertising claim sure to be disputed by attorneys for J&J/Merck, SmithKline Beecham and Warner-Lambert.

The prevention market is where it's at for H2 blockers because they don't work as well as antacids in treating heartburn. Antacids absorb acid and have the fast onset of action sought by those who treat heartburn symptom after they arise. An H2 blocker that emphasizes treatment has a hard time competing against antacids and wi never win against H2s that focus on prevention. SmithKline Beecham learned that with Tagamet HB; after coming to market with only the treatment claim, it quickly sought FDA clearance to make the claim of prevention. The company is now reportedly seeking to strengthen its prevention claim by seeking FDA clearance of a higher strength dosing regimen.

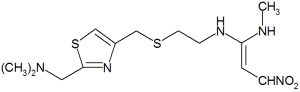

By focusing exclusively on the prevention market with what will undoubtably be aggressive claims, Whitehall-Robins is pursuing the best course for turning Axid AR into a power brand. It must overcome being the fourth Rx-to-OTC switch H2 blocker to arrive in stores and virtually nonexistent brand equity. Tagamet HB and Zantac 75 benefited from their extremely high brand awareness, and even though Pepcid AC wasn't a familiar name to consumers, it did not seem to matter because it was the first to market. Axid AR will become one of the dominant brands in the gastrointestinal category. That's an eventuality ensured by the marketing muscle of Whitehall-Robins and the fact that Axid AR's active ingredient, nizatidine, is an effective drug.

Rough and ready

It won't be a smooth ride though. Marketers of the four H2 brands are competing in a category on its way to annual sales of $1 billion. Each company will skate as close to the edge as possible in touting its product's benefits. There will be many more depositions, lawsuits and arbitrations over advertising. In the end, Zantac 75 will sit atop product movement reports. Pepcid AC arid Axid AR will battle for the No. 2 spot. Tagamet HB will settle in at No. 4 because even though it has an excellent safety profile, contraindications on its label mean that pharmacists will more often than not recommend one of the other H2s.

On an unrelated note, we have a new telephone system in the Tampa office of Drug Store News. I can now be reached at (813) 627-6946. The fax number remains the same, (813) 664-6776.

COPYRIGHT 1996 Reproduced with permission of the copyright holder. Further reproduction or distribution is prohibited without permission.

COPYRIGHT 2004 Gale Group