There are more than 54 million sufferers of frequent heartburn and most of them are seeking treatment, so it's not surprising that consumers are still gravitating toward one of several relatively recently switched heartburn remedies: Prilosec OTC and Maximum Strength Pepcid AC in late 2003 and Zantac 150 in January.

Much of the growth in the antacid category can be traced to these new product introductions. Together, Prilosec OTC, Zantac 150 and Maximum Strength Pepcid AC alone generated incremental dollar sales growth of almost $30 million in drug stores during the 52 weeks ended Sept. 4, according to Information Resources Inc. And clearly these introductions cannibalized sales of existing brands in the category. Total incremental growth for the entire antacid tablet category reached only $21.2 million in drug stores. Overall, category sales reached $454.6 million in drug stores, up 4.9 percent during the period.

Still, there are some signs that new users are coming to the category, which should spark more organic growth trends going forward.

"There's a migration to higher-efficacy products," commented Bryan Holmes, group marketing director for Pfizer's gastrointestinal line of products. "What we've seen in addition to that is there is increased treating among the consuming public."

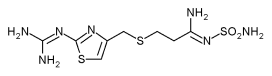

That increased use also is a tribute to the marketing prowess of each of the major suppliers in the heartburn space. However, the benefit provided by each of the heartburn remedies can differ significantly. Calcium-based antacids provide immediate relief that typically lasts one hour to two hours. H2-blockers that inhibit the production of acid in the stomach can provide up to 12 hours of relief, but typically take up to an hour before that relief starts kicking in. Proton-pump inhibitors can take between one day and four days before that pump-inhibiting action is fully effective. But when PPIs take effect, they can relieve heartburn for up to 24 hours with one pill each day.

All of that differentiation can be a lot for a consumer to process, which may be the reason why they become loyal to a brand when they find a product that works for them.

Looking forward, some of that brand loyalty may face some private label erosion within the next year, even though sales of private label antacids slipped 0.6 percent in the 52 weeks ended Sept. 4, according to IRI. Perrigo already has received tentative approval from the Food and Drug Administration to make and market over-the-counter famotidine tablets USP, 20 mg, the generic equivalent to Maximum Strength Pepcid AC. Perrigo is expecting final approval when the new product exclusivity expires Sept. 23, 2006, which is around the time that Prilosec OTC may be facing private label competition, as well.

Further supporting the strength o the segment's potential, a study published earlier this month in the American Gastroenterological Association journal Clinical Gastroenterology and Hepatology confirmed what has long been assumed: Americans' lifestyle and eating habits are not only adding more inches around the waistline, but that added weight is contributing to more gastrointestinal distress, which in turn may be driving consumers to their local drug stores for relief.

Researchers found that a high body mass index, coupled with a lack of physical activity, was associated with an increase in gastrointestinal symptoms, such as stomach pain, diarrhea, constipation and irritable bowel syndrome.

On average, participants in the study were classified as obese with an average body mass index of 33. More than 60 million Americans have a BMI greater than 30. And that works out to a lot of upset stomachs.

COPYRIGHT 2005 Reproduced with permission of the copyright holder. Further reproduction or distribution is prohibited without permission.

COPYRIGHT 2005 Gale Group