ONE BY one, the bears have been tamed. Sceptical fund managers and grizzly analysts have been beaten into admissions of defeat by the relentless rise of Galen's share price - and, to be fair, by the dramatic improvement in profits at the Northern Irish maker of hormone replacement therapies and contraceptive pills.

The company beat forecasts again with quarterly figures to 31 December. Pre-tax profit was $49.0m, up from $15.2m, on sales which have doubled.

But the worry is that this is all driven by acquisitions. Galen buys products too small to be given attention by large drug groups, but which may thrive when given to its growing sales force. The company also places a lot of hope on developing "line extensions". For instance, Ovcon, a contraceptive pill, will be launched in a chewy mint version. It is difficult to guage the appetite for such a product, but it is unlikely to be huge.

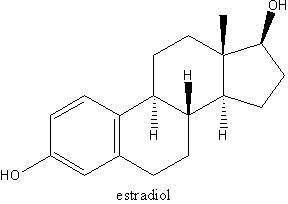

The newly-acquired products are yet to show they can substantially grow under Galen, rather than simply swell the company's size. Prescription data shows continued declines, although Galen raised prices to compensate. Longer-term, HRT demand could be weakened by numerous health scares.

If it hadn't been for acquisitions, we would all be very worried about the disappointing sales of Femring, the first product Galen created in- house. It is a vaginal ring used to deliver HRT drugs, and early hopes for sales of $50m a year now look impossible to achieve.

Galen has taken a while to establish trust in the City, which long remembers a reputation for obfuscation and lack of detail in financial results. But we missed a trick by advising readers to shun the shares last summer. That trust has been accumulating, thanks to good results and innovative moves to keep generic copies of its drugs off the market. Even now, Galen shares are on an earnings multiple below the average for companies with a similar strategy, so abstinence could prove painful again. None the less, long-term investors remain safer out than in.

Copyright 2004 Independent Newspapers UK Limited

Provided by ProQuest Information and Learning Company. All rights Reserved.