GOOD times lie ahead at publisher Pearson if it follows the advice of a big City hitter.

US broker Morgan Stanley has upgraded it from equalweight to overweight and lifted its target from 720p to 800p. That could grow to 950p if the group decides to sell prize assets such as the Financial Times and FT.com, returns Pounds 1.75 billion to investors and brings its substandard margins of 11.8% into line with the industry norm of 17%.

MS describes trading as strong, buoyed by positive trends in US schools and higher education, where it publishes textbooks.

There are also signs of recovery at Penguin Books and the FT. As a result, it has pencilled in three years of double-digit earnings growth and improving cashflow and returns.

The shares today climbed 261/2p to 713p, making them one of the best performers in the Footsie.

Investors appeared to put this week's high drama in Tokyo firmly behind them as they chased share prices in London back above the 5700 level. The expiry of the January series of options and futures passed without a hitch and the FTSE 100 index rose 27.6 to 5720.8.

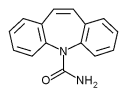

Shire Pharmaceuticals extended this week's lead with a rise of 681/2p to 9031/2p after settling its legal dispute with generic rival Impax over its treatment for attention deficit disorder, Adderall XR.

Impax will now be permitted to market a generic version by January 2010 but must pay Shire a royalty from any sales of it. It also means Impax has secured the right to enter the market as Shire's authorised generic. In return, Impax will promote Carbatrol, Shire's treatment for epilepsy in the US, in return for payments on current sales.

BT fell 43/4p to 2041/2p, on the threat of competition from supermarket giant Tesco, up 4p at 3171/4p, which is launching its own broadband telephone business. Broker Seymour Pierce has kept BT at outperform. Vodafone retreated 11/4p to 120p ahead of a trading update.

Lloyds TSB marked time at 516p.

The shares were chased sharply higher yesterday, with more than 60 million changing hands in the belief that the Sage of Omaha, Warren Buffett, was attempting to buy a stake. There has been a lot of bid talk in the sector, but some brokers say the shares are being bought ahead of the full-year dividend reporting season which gets under way soon. Lloyds TSB has always been a firm favourite with income funds because of its near-7% yield.

Northern Rock was also popular, up 61/2p to 944p. Broker Merrill Lynch has repeated its buy rating and 1168p target. It says the shares are significantly better value than those of Alliance Leicester, up 6p at 974p, and Bradford Bingley, 21/4p better at 407p.

Brokers are divided about the prospects for International Power, down 5p at 271p. Williams de Broe continues to recommend a buy and 300p target.

The shares performed strongly in 2005 and the broker has been forced to rework its forecasts, but the current rating of 16.7 times earnings remains undemanding.

In contrast, Dresdner Kleinwort Wasserstein points out the price has risen 10% during the past week, driven by earnings upgrades and bid hopes. But it is sceptical of an offer emerging and warns high gas prices in the wake of Hurricane Wilma in the US may only be temporary. A bid from German utility RWE is also unlikely, as it is disposing of its US and Thames Water businesses.

Computacenter recovered its poise, rallying 143/4p to 256p in the wake bid talks breaking down earlier this week. UBS has raised its earnings forecast for the year just ended from 7.2p a share to 10.4p and from 11.9p to 13.7p for the current year. It expects all the improvement to come from France, with the UK and Germany remaining stable.

The broker has lowered its sights from 260p to 240p.

A better performance from Argos has prompted UBS to raise its pretax profit forecast for GUS, up 28p at 10021/2p in the current year from Pounds 815 million to Pounds 830 million. It has pencilled in Pounds 775 million for 2007.

UBS says Argos earnings are now expected to improve when it had been looking for a fall. A better performance at the catalogue shops chain also raises the prospect of GUS's credit rating business Experian being demerged this year, rather than next. UBS repeated its buy rating and 1170p target.

(c)2006. Associated Newspapers Ltd.. Provided by ProQuest Information and Learning Company. All rights Reserved.