SMG SHARES took a pasting yesterday as a downgrade by ABN Amro, the house broker to the media group, knocked 11 per cent off the stock market value of the company. As word leaked into the market that the Dutch broker had slashed its 2003 earnings forecasts for SMG, traders rushed for the exit and sent the stock down 10p to 75p. House brokers are generally held to be very close to the company they advise and so yesterday's downgrade would suggest that things are going pretty badly for the media group. Although ABN retained its "buy" rating on the stock, dealers expect this to be slashed in the near future.

SMG is currently believed to be facing difficult trading conditions. Advertising markets, key for the media group, are said to have remained very tough throughout the first half of the group's financial year. Revenues from ITV and radio are heard to be particularly week. In fact the only likely bright stop at SMG, according to sector specialists, is its Out of Home billboard unit which is said to be enjoying double digit growth.

UBS Warburg, which also slashed its forecasts yesterday, expects pre- tax profits for the first half of the current year to collapse to pounds 5m compared with pounds 10m in the same period last year. The Swiss broker believes SMG will experience a 5 per cent decline in ITV broadcasting revenues for the first half and a more dramatic 11 per cent drop in radio advertising.

Meanwhile, the FTSE 100 index rose 17.9 points to 4,024.8 as investors brushed aside weaker-than-expected US economic data. The figures on the American economy were certainly not positive as they showed the country's unemployment rate rise to its highest level since April 1994. However, strong gains by blue chip pharmaceuticals supported the index. GlaxoSmithKline rose 40p to 1,235p while AstraZeneca improved 95p to 2,500p.

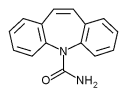

Shire Pharmaceuticals was not so lucky, falling 9.5p to 376.75p, on fears of generic competition for its Carbatrol drug. Investors were unsettled by an announcement from the US Food and Drug Administration which said that an unnamed drug manufacturer had asked it to approve a copycat version of Shire's epilepsy treatment. Analysts estimate that Carbatrol currently accounts for around 5 per cent of the group's total sales.

Next jumped 18p to 1,028p after Deutsche Bank upgraded its rating to "buy" from "hold" and told its clients that good things are on the way at the retailer. Deutsche reckons trading is strong at Next and believes it will remain so as the company prepares to expand later this year via new store openings.

The German broker also drew investors' attention to the fact that Next has been buying back its own shares at a impressive rate. So far this year it has bough back 4 per cent of its share capital, compared to expectations of 3.5 per cent. Elsewhere, BT Group lost 2.5p to 195p as a massive 137 million shares changed hands. Dealers said the exceptionally high volume was due to one brokerage in the City positioning itself for a dividend strip.

About 10 per cent of Christian Salvesen's equity crossed the market at 50p yesterday, sending shares in the logistics group 2p lower to 53p. Word has it AB Custos, the Swedish investment company, placed its 10 per cent stake in Salvesen in the company with various institutional investors. In 2000, the Swedish group tried to table a bid for Christian Salvesen, but was rebuffed.

Bookham Technology dropped 12p to 73p as the Canadian telecom equipment maker Nortel halved its 30 per cent stake in the group. Nortel is believed to have sold 30 million Bookham shares at 67p each through broker Credit Suisse First Boston. According to Evolution Beeson Gregory, the disposal by Nortel, which is both Bookham's biggest customer and shareholder, does not bode well for the UK group.

"Surely Nortel would not have disposed of the shares now had the business been on the verge of a turnaround?" asked the broker as it urged investors to sell Bookham. The UK optical components maker is at present struggling to break even, causing it to burn through its pounds 75m cash pile at the rate of knots. Evolution reckons there maybe just pounds 14m of cash left by the fourth quarter of this year.

Alba added 7.5p to 510p despite news that its chairman, John Harris, and his family had sold a substantial chunk of their holding. Investec Securities placed 5.1 million Alba shares, or 10 per cent of the television set maker, on behalf of the Harris family at 495p. The old story of a bid for the sausage skin maker Devro helped its shares 2p higher to 72p. According to gossips, Acomita Investments, which controls 14 per cent of the company, is considering a 80p-a-share cash bid.

ImaginationTechnologies rose 3p to 59p as the chip designer raised pounds 4.4m through a placing of 8.5 million new shares at 53.5p each.

Copyright 2003 Independent Newspapers UK Limited

Provided by ProQuest Information and Learning Company. All rights Reserved.