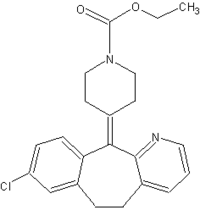

KENILWORTH, N.J. -- Schering-Plough announced Jan. 31 that it has filed separate suits against Johnson & Johnson's McNeil Consumer Healthcare and American Home Products' Whitehall-Robins Healthcare for an alleged patent infringement on the company's prescription loratadine product, Claritin. According to Schering-Plough, the suits "seek to prevent McNeil and Whitehall from manufacturing, using, selling or otherwise making a loratadine product until after the expiration of the metabolite patent [desloratadine]." Desloratadine is listed as the active ingredient in Clarinex, a prescription-only allergy remedy that is expected to be Claritin's successor.

In 1998 Wellpoint Health Networks of California petitioned the U.S. Food and Drug Administration to force the Rx-to-OTC switch of Claritin, Allegra (Aventis Pharmaceuticals) and Zyrtec (Pfizer)--an unprecedented move-based on the fact that such a move would save hundreds of millions in U.S. health care costs. On May 11, 2001, two FDA advisory committees recommended that the three products were safe enough to be switched. FDA has yet to issue a final ruling.

McNeil and Whitehall filed new drug applications with the understanding that the patent for loratadine expires December 2002. Schering-Plough is attempting to win extended exclusivity to market loratadine by enforcing its loratadine-metabolite patent on desloratadine, which doesn't expire until October 2004.

"We filed a new drug application with the FDA to introduce an OTC form of loratadine," explained Mark Gutsche, a McNeil spokesman. "We believe our position respects Schering-Plough's patent on loratacline, which is scheduled to expire this year."

"Whitehall is confident in [its] position that the claims of [the loratadine] patent are invalid and/or not infringed," said Fran Sullivan, a Whitehall-Robins' spokesman.

Claritin has posted annual prescription sales totaling more than $2 billion, according to industry estimates. Schering-Plough was already facing a sharp drop in its sales of Claritin by year's end, as competition from generic drug manufacturers moved into the business. Availability of loratadine as an OTC remedy would exacerbate this sales decline.

"The more important story is that J&J and American Home (Wyeth) are major pharmaceutical companies who are pursuing an alternative to the existing switch system," commented Steve Francesco, publisher of Switch magazine. "If this turns out to be successful, [it creates] a template to do third party switches for other products."

Other drug categories that may be open to this switch strategy include digestives, birth control remedies and cox-2 inhibitors, Francesco said. This list includes acid reflux-remedy Prilosec, which pulled in more than $4 billion in annual sales for AstraZeneca.

COPYRIGHT 2002 Reproduced with permission of the copyright holder. Further reproduction or distribution is prohibited without permission.

COPYRIGHT 2002 Gale Group