With the carefully planned launch of AstraZeneca's Crestor imminent, it's uncertain what share the drug could grab of the mature multibillion-dollar statin market. There is agreement among industry experts, however, that overall costs in the category are moving upward.

The statin market is dominated by Pfizer's Lipitor--the best-selling drug in the world, according to Pfizer--which generated more than $2 billion in revenue during the second quarter of 2003. The total market for cholesterol-lowering medications is estimated to be worth some $16 billion this year (DCMR 11/02, p. 1).

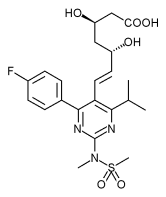

Originally touted as a "super-statin," Crestor's extensive clinical trials identified health risks at dosages above 40 mg, so the drug will be available in doses of 5, 10, 20 or 40 mg. That meant that Crestor would enter the arena as a competitor--but not a heavyweight--for high-efficacy statins such as Lipitor and Merck's Zocor. FDA approval of Crestor came on Aug. 12.

An advantage of Crestor, however, is that its cost is fixed across the dosage range at an average wholesale price (AWP) of $2.10 a pill. AstraZeneca still claims the product is more potent per milligram than other statins available, so in theory patients who require larger dosages of other statins could be treated at a lesser cost using Crestor. For example, Lipitor's AWP starts at $2.47 per 10 mg pill, with any larger dose costing $3.64 per pill; Zocor's AWP is $2.62 at 10 mg, and spikes to $4.58 for all larger doses.

"If you're going to get Crestor on somebody's formulary, the issue will be how much in rebates AstraZeneca is going to offer," says Craig Stern, Pharm.D., president of ProPharma Pharmaceutical Consultants, Inc. "The recommendation we've been making is to be sure there is an evidence-based study done for a client's specific patient population" to determine how many are in need of the high-power statins like Crestor, he notes. Stern adds that AstraZeneca "wants to say Crestor is more potent than these other drugs and it costs less, but 80% of cholesterol patients will be brought under control using drugs that are available now."

Some PBMs are jumping on the bandwagon right away, though. Innoviant--which offers a step-therapy program specifically for the statin category (DCMR 8/29/03, p. 4)--will add Crestor to its preferred list for statins alongside Lipitor. "The blended average net cost of a statin prescription should decrease slightly based on the introduction of a lower-cost option and increased market competition," says Mary Jenkins, Pharm.D., the company's vice president of clinical services. But other factors, such as more publicity and marketing in the statin class, could increase total spending, she notes.

Many Skeptical, Look to Generics

Medco Health Solutions expects its P&T committee "will review Crestor and the entire statin category sometime in October," says Glen Stettin, M.D., vice president of clinical products. But "category costs will grow, Crestor or not," he adds, pointing to a larger aging population that proportionally could increase utilization. Stettin says that Medco Health "is eager to have generic versions of Zocor and Pravachol available, as based on our history of generic substitution rates--especially through mail service--we will be able to achieve significant cost savings for our clients."

Kyle Vance-Bryan, Pharm.D., chief pharmacy officer at Prime Therapeutics, says the company "views [Crestor] as another 'me too' product." He contends that "essentially all of the available statins do a good job managing lipid levels." So Prime Therapeutics "isn't going to be in a hurry to make decisions" about Crestor, nor will WellPoint Pharmacy Management and Anthem Prescription Management.

Furthermore, Prime Therapeutics finds that most patients can reach their target cholesterol levels using cheaper, lower-strength drugs such as lovastatin, the generic version of the original statin, Merck's Mevacor. "About 60% to 70% of the population can have their lipid-lowering needs met with generic Mevacor, which has long-term outcomes and safety data to support it," according to Vance-Bryan. He adds that the savings achievable through using lovastatin instead of other statins "are quite significant."

Call Stern at (818) 701-5438, Innoviant's Rhonda Grabow at (715) 841-5013, Medco Health's Ann Smith at (201) 269-5984 or Prime Therapeutics' Teresa Storm at (651) 286-4191.

COPYRIGHT 2003 Atlantic Information Services, Inc.

COPYRIGHT 2003 Gale Group